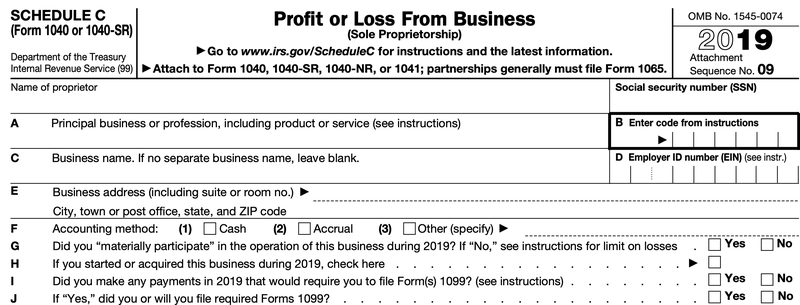

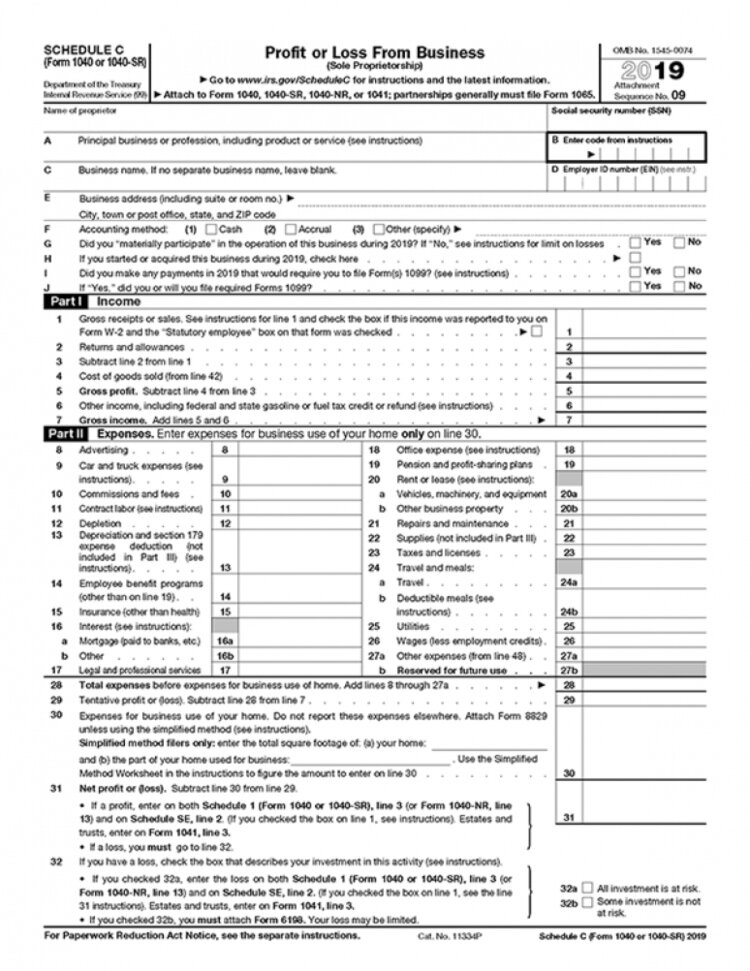

If you are filing a 1099MISC with income in Box 7, you will be prompted to Add the income to an existing Schedule C or create a new Schedule C after completing the 1099MISC entry If you receive a 1099K, the IRS requires this income to be reported as income on the Schedule C For more information about the 1099K, please click hereFeb , 21 · If you are selfemployed, an independent contractor, or received any income as a 1099 nonemployee in a given tax year, you'll most likely need to file Schedule C Profit or Loss From Business The Schedule C is set up similar to the Form 1040;Assign the Form 1099MISC that you just entered to the applicable Schedule C from the Assigned form or schedule dropdown list Please refer to IRS Publication 334 Tax Guide for Small Business for additional information regarding selfemployment tax what it is, who pays it, how it's calculated and reported, etc

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Schedule c independent contractor 1099 form

Schedule c independent contractor 1099 form-Independent contractor filing for PPP I use QBO and file w/ TurboTax self employed, but can't file 19 tax yetMar 18, 21 · If payment for services you provided is listed on Form 1099NEC, Nonemployee Compensation, the payer is treating you as a selfemployed worker, also referred to as an independent contractor You don't necessarily have to have a business for payments for your services to be reported on Form 1099NEC

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

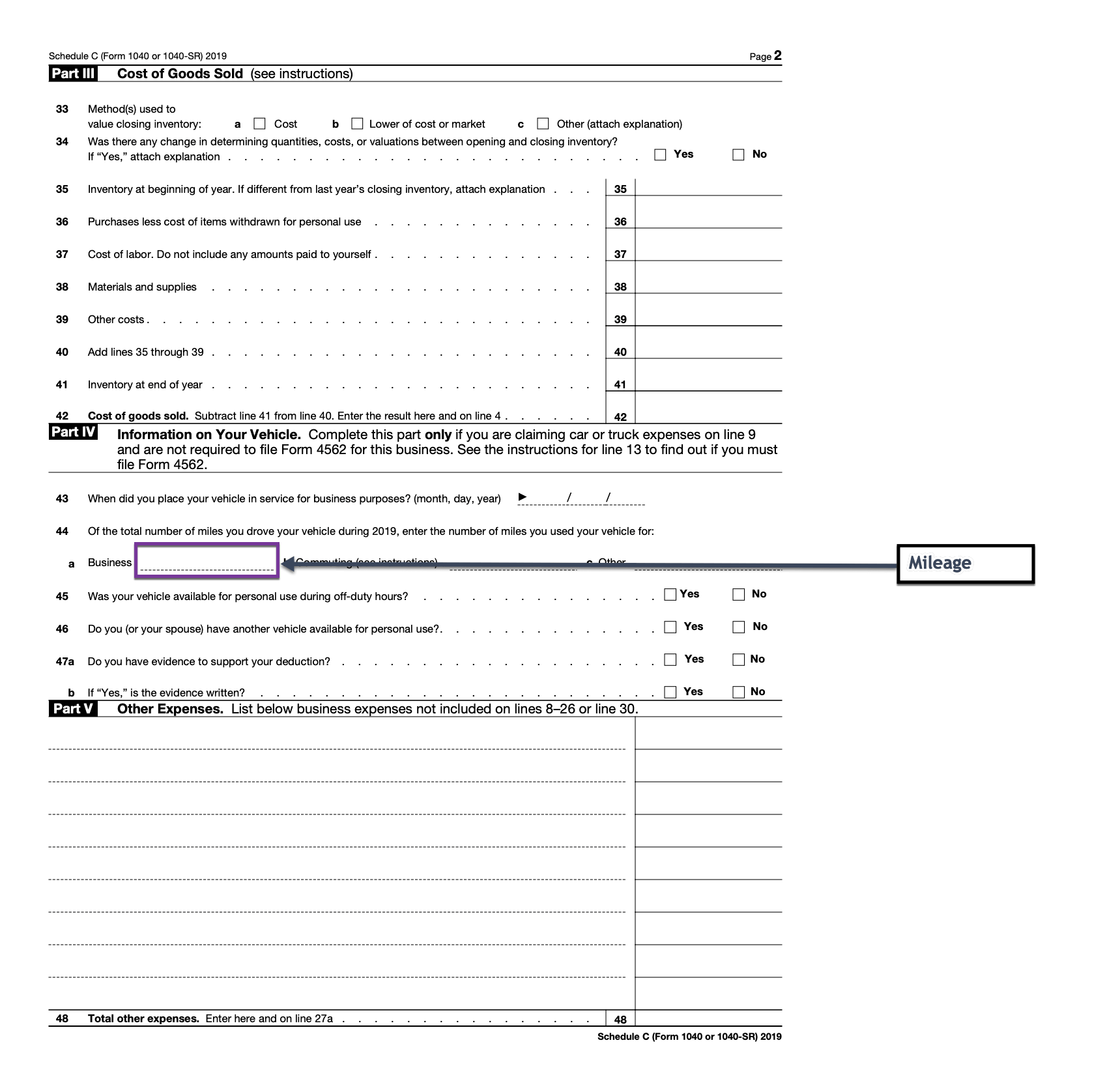

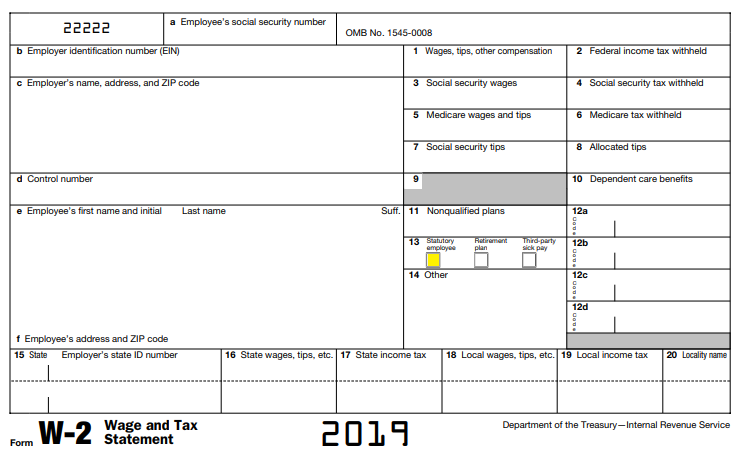

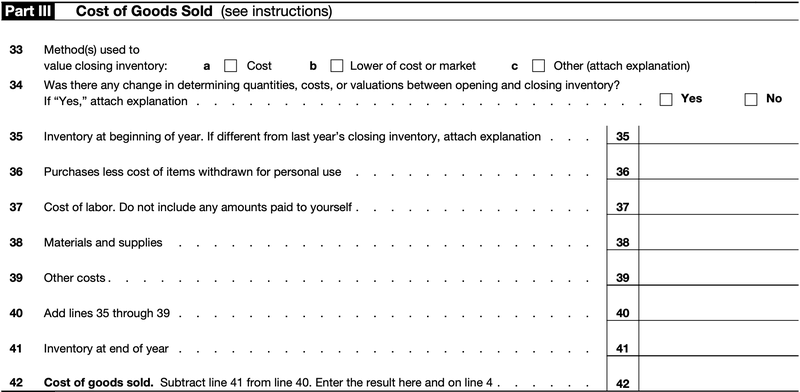

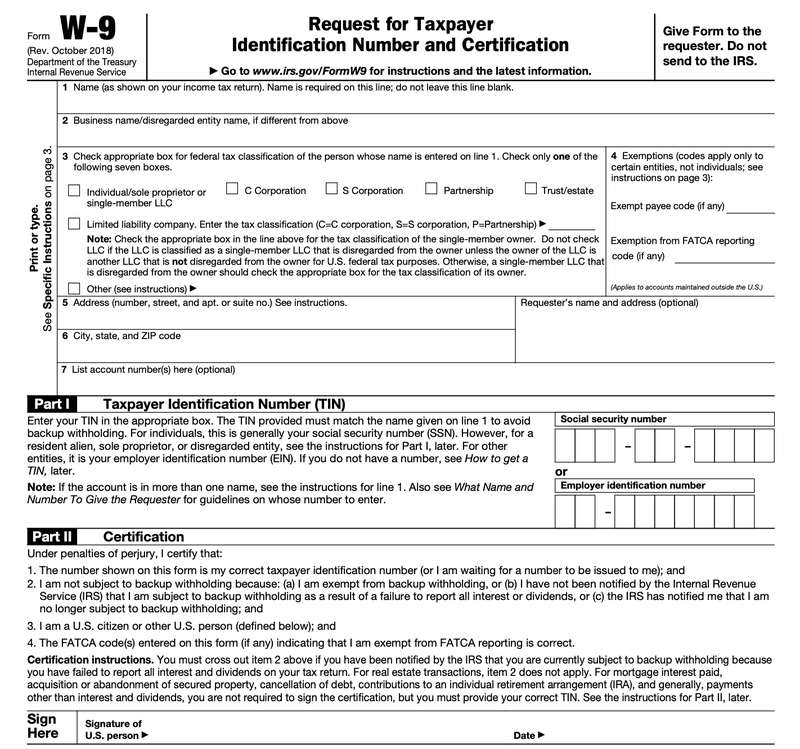

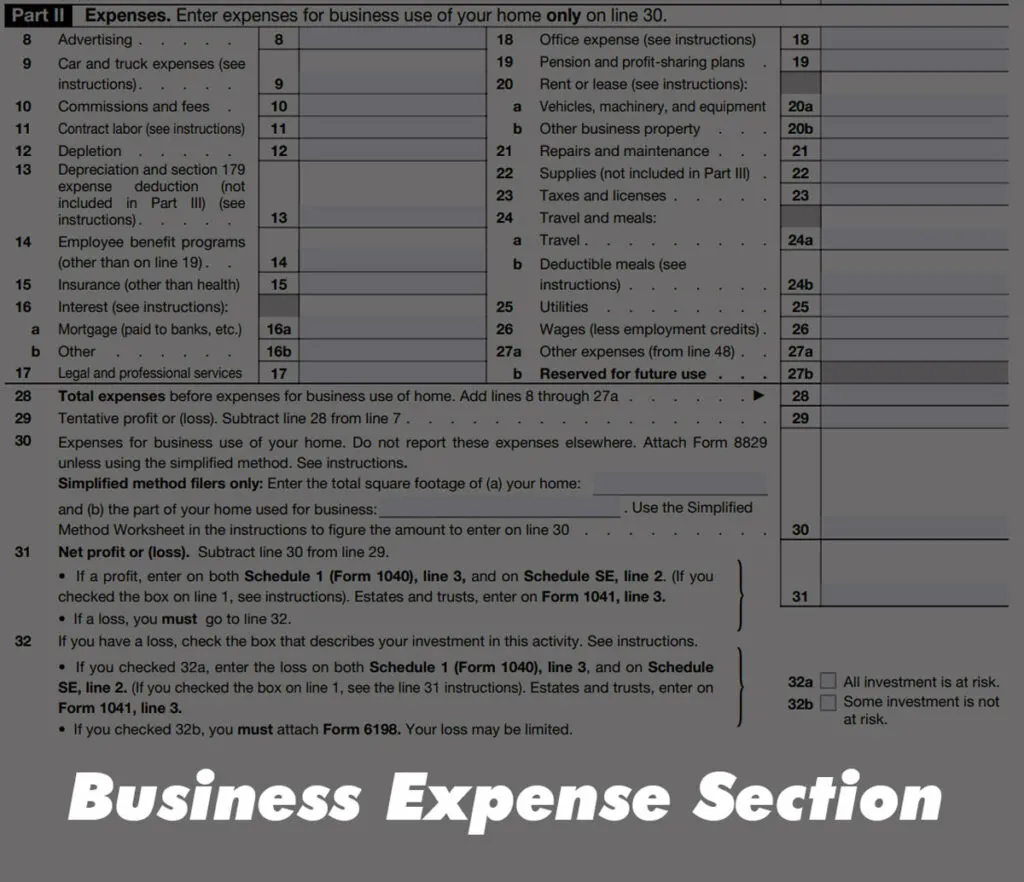

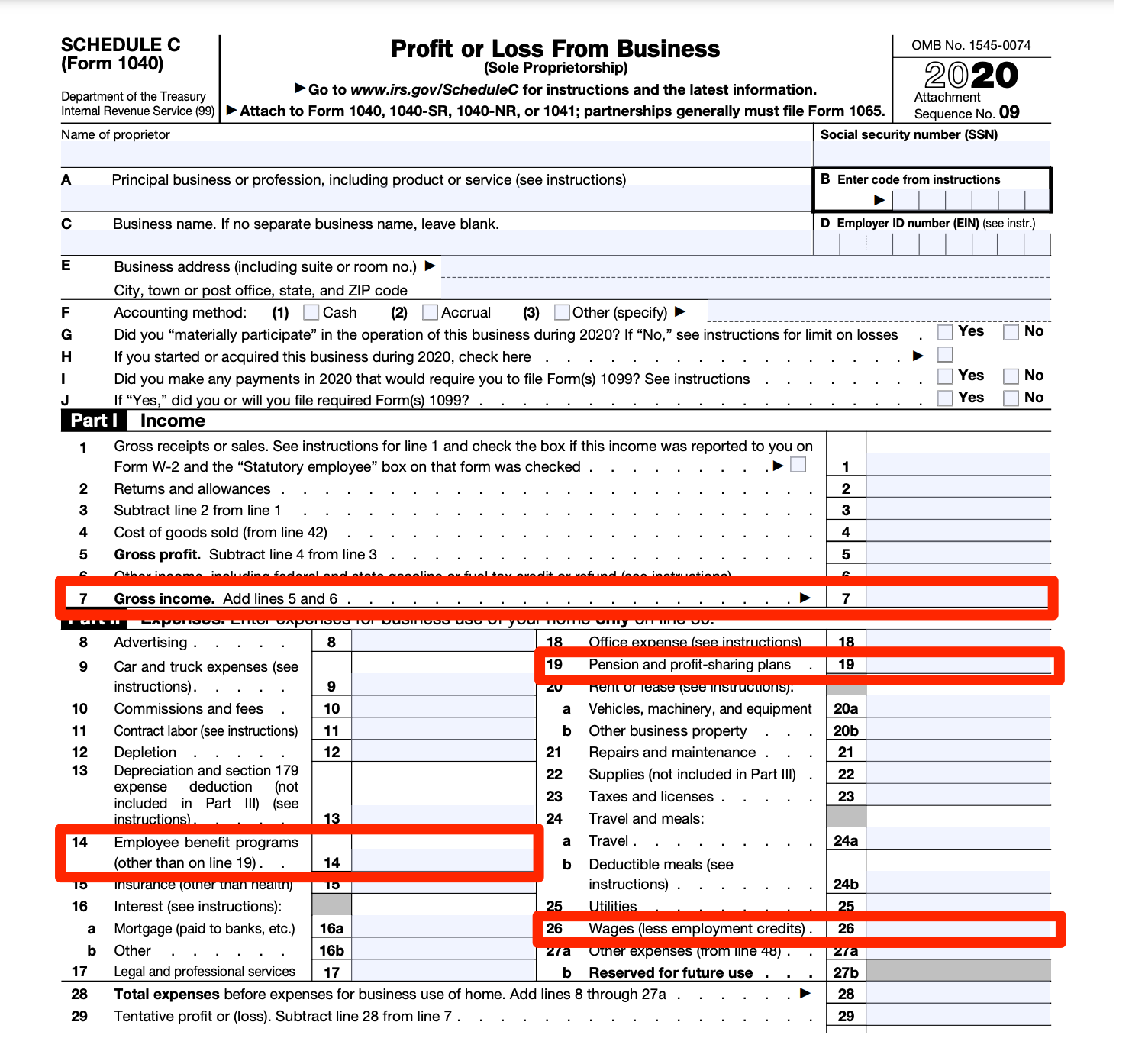

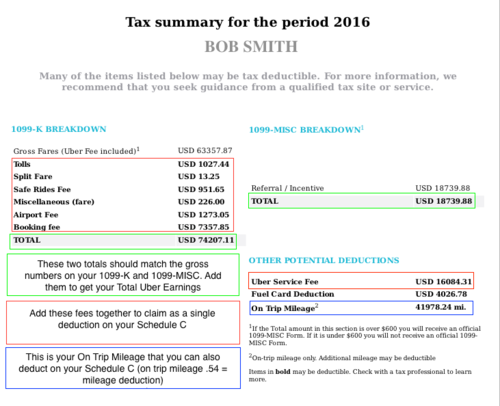

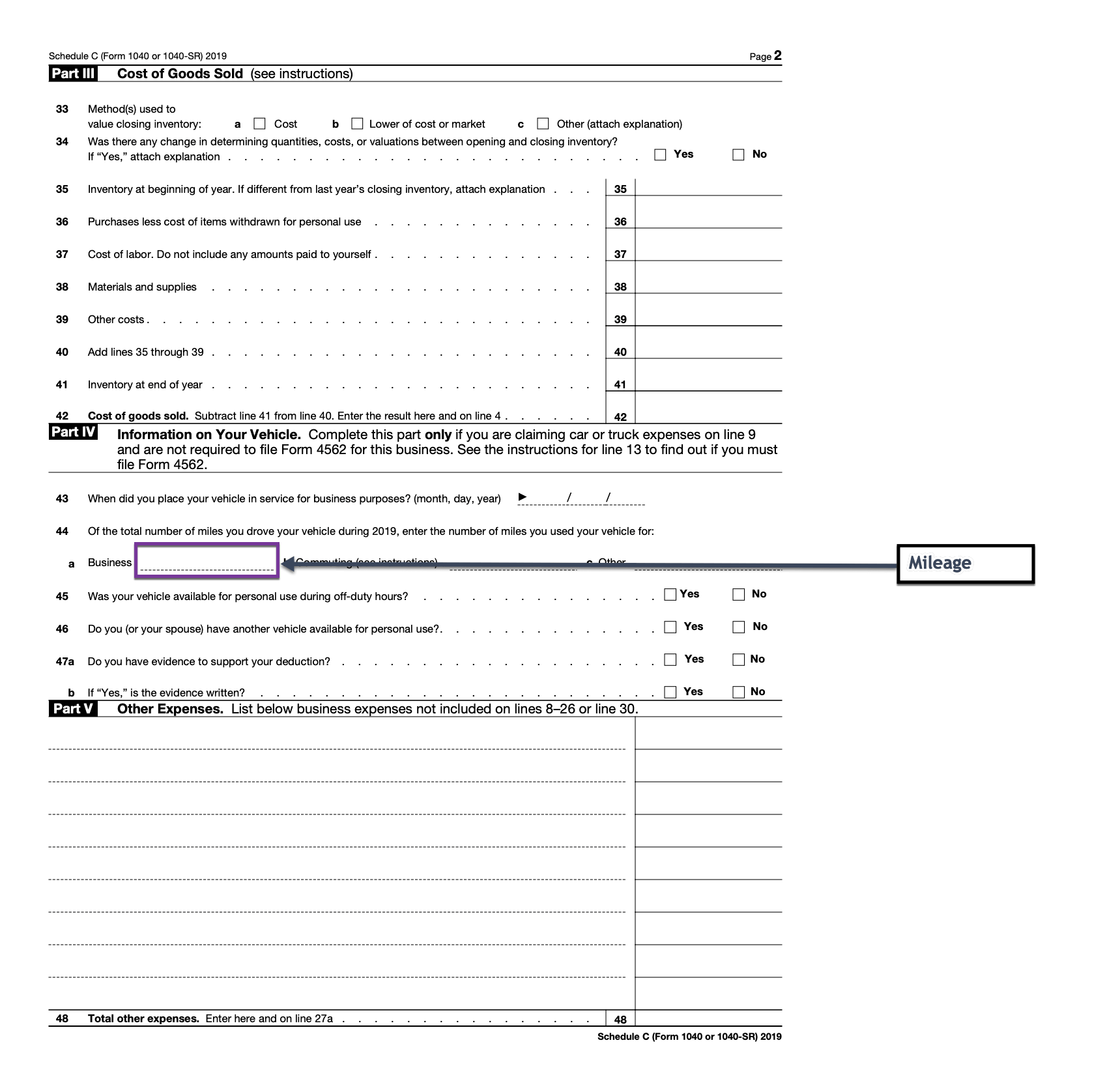

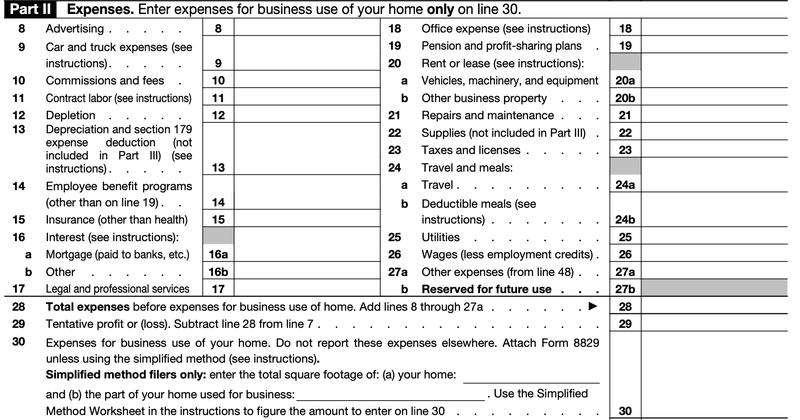

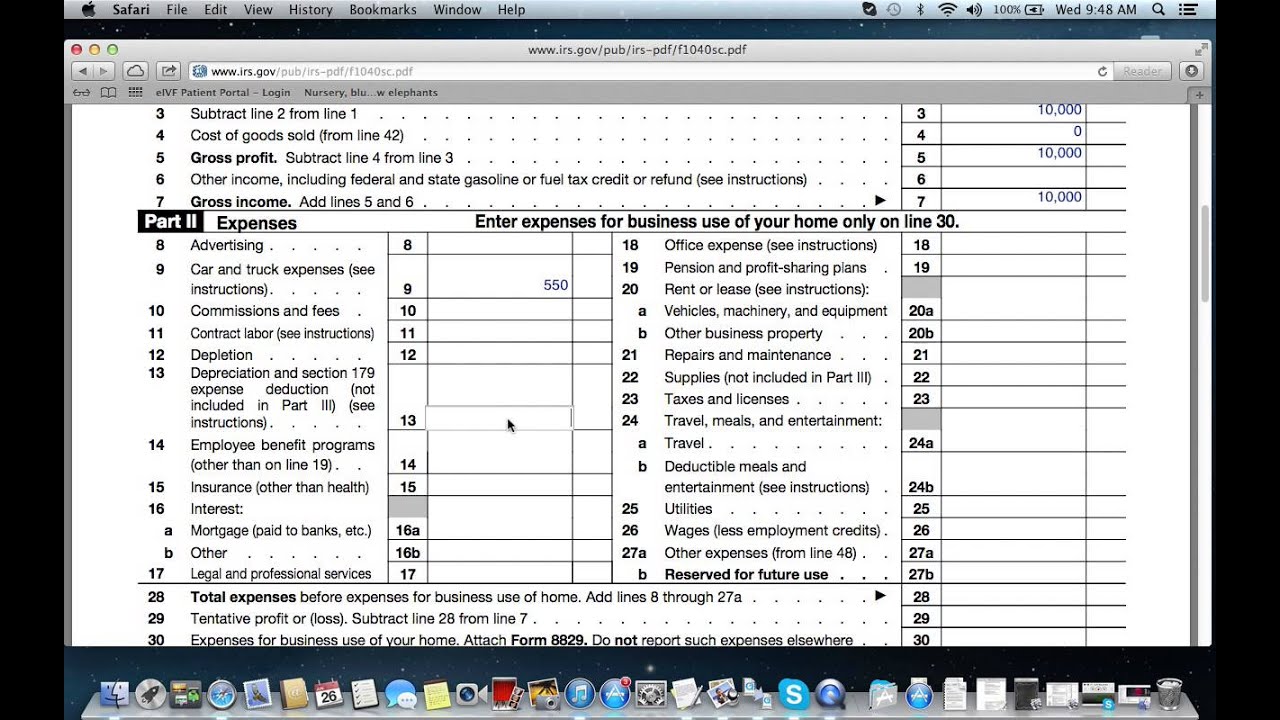

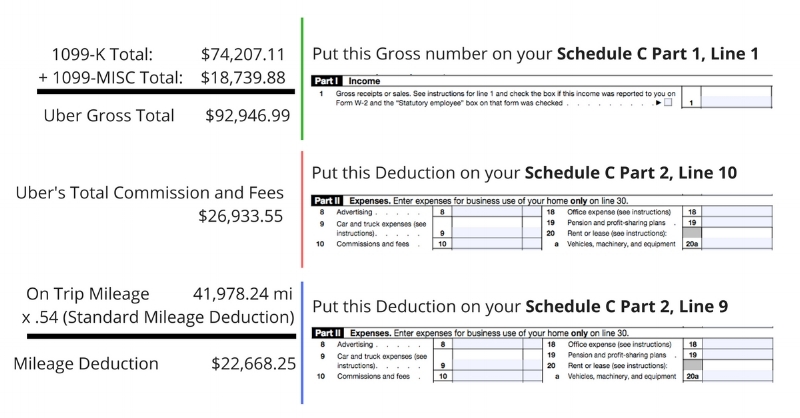

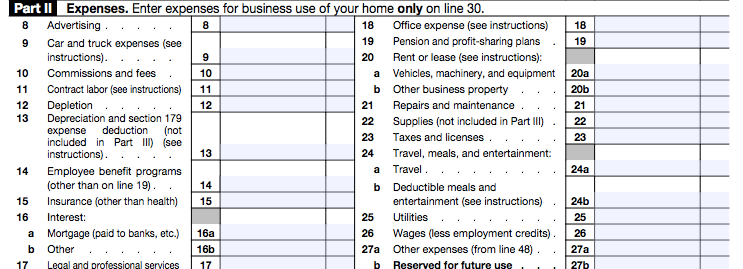

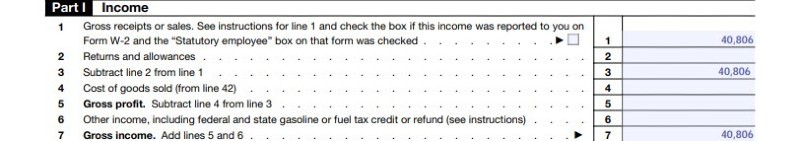

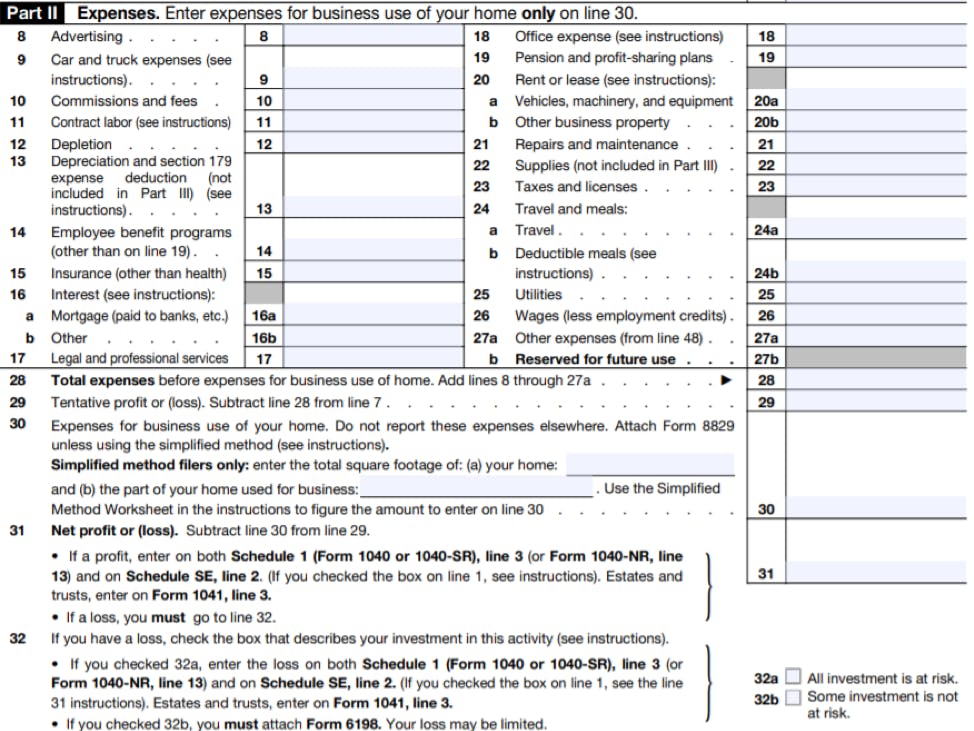

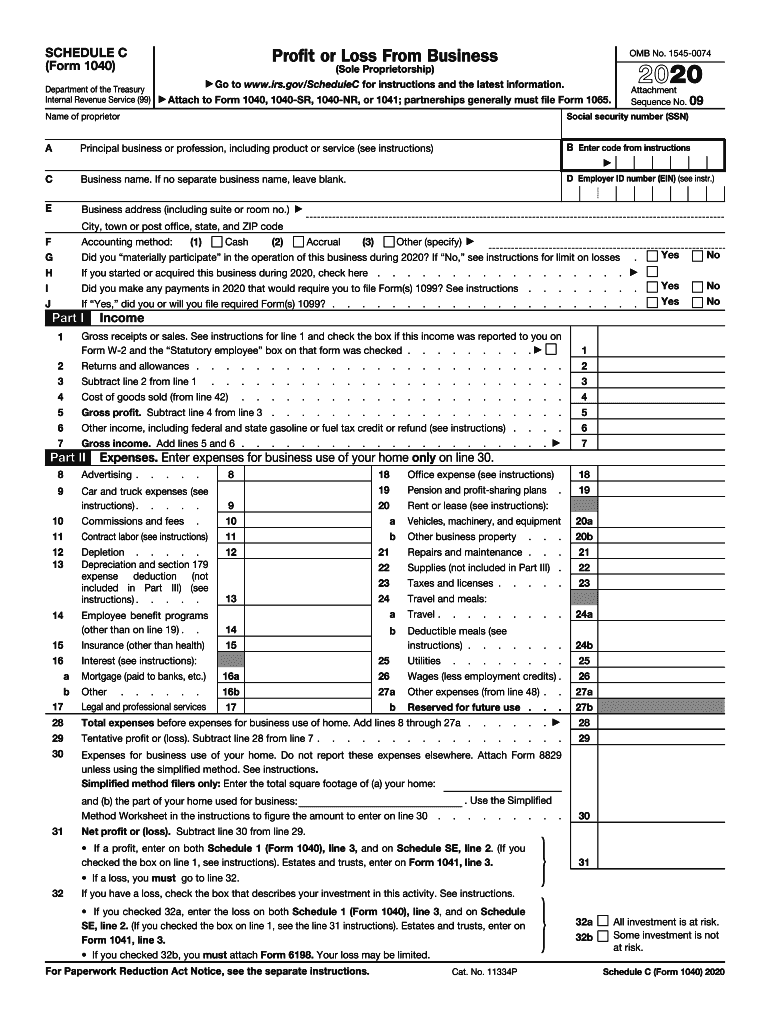

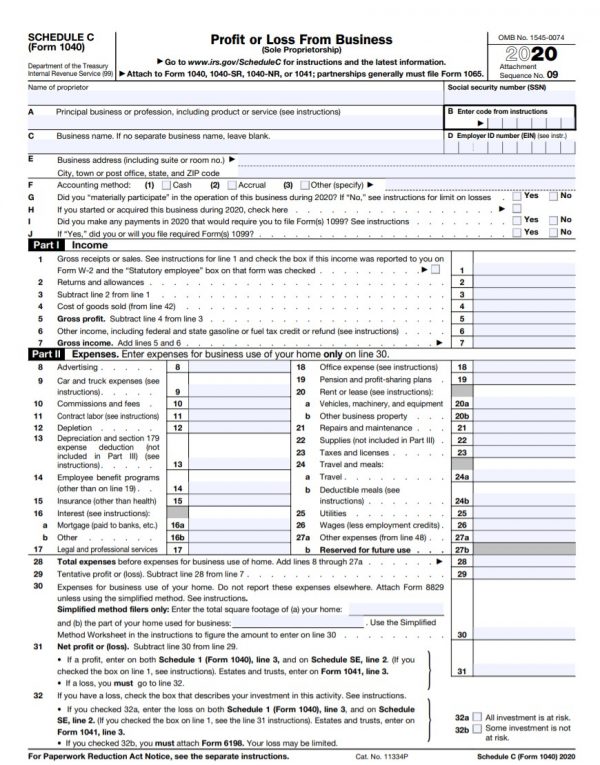

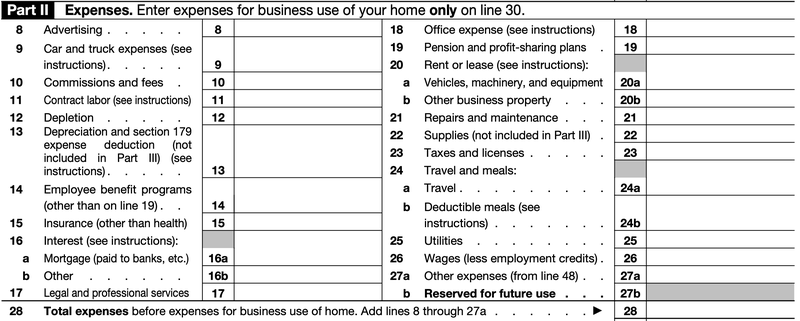

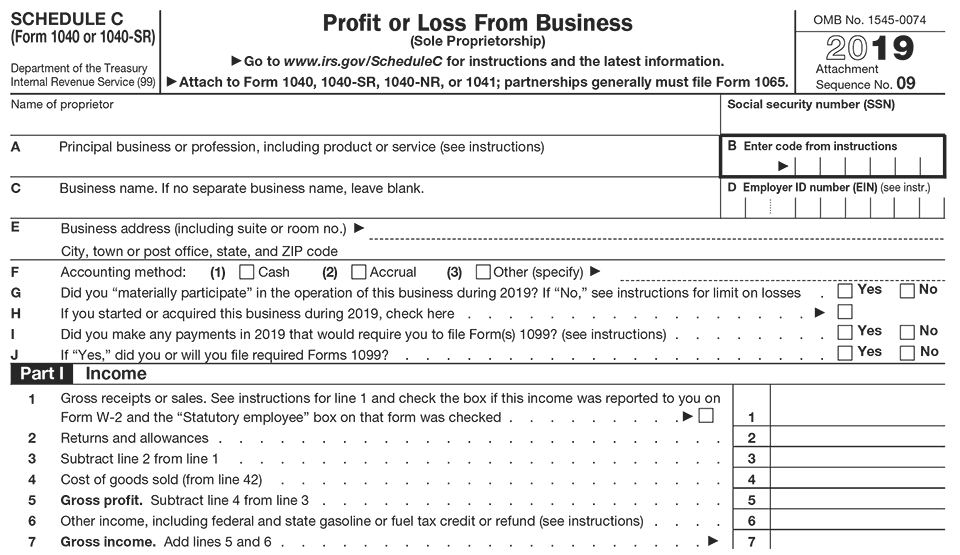

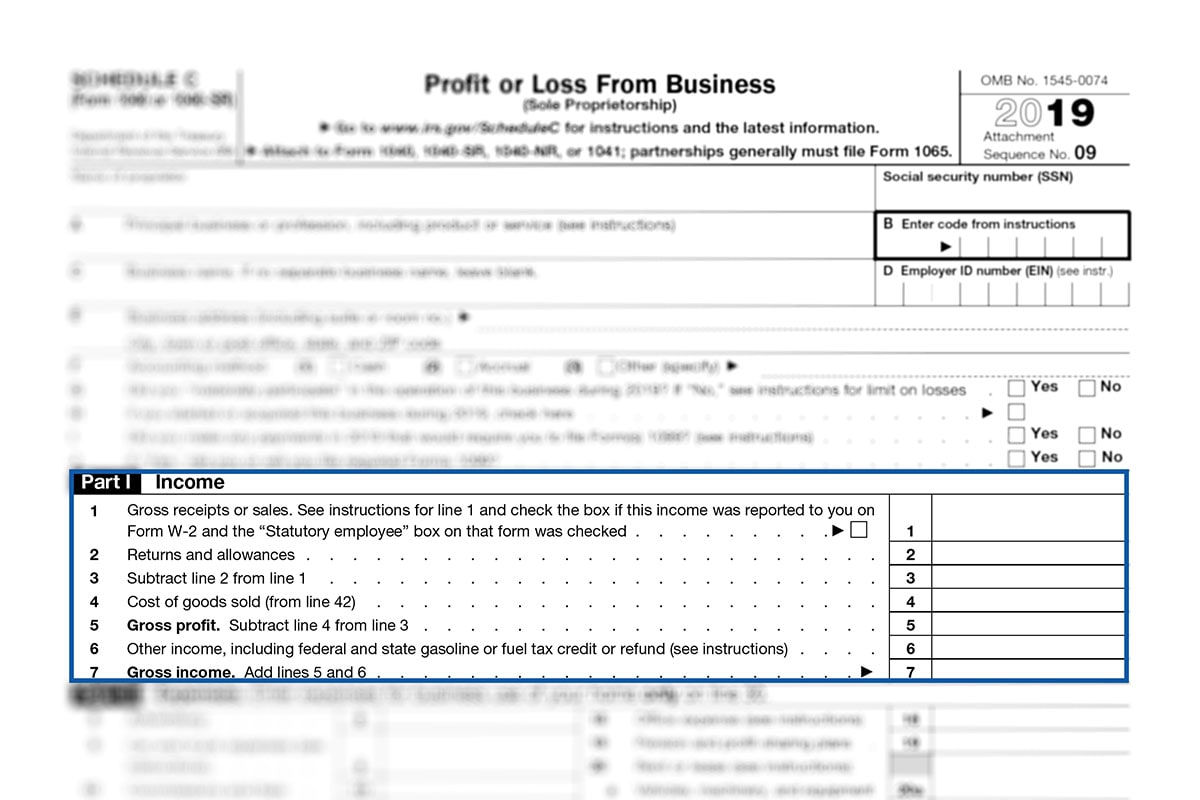

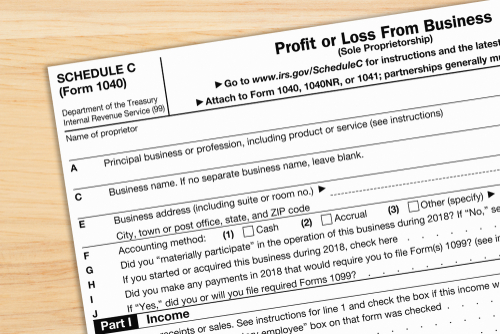

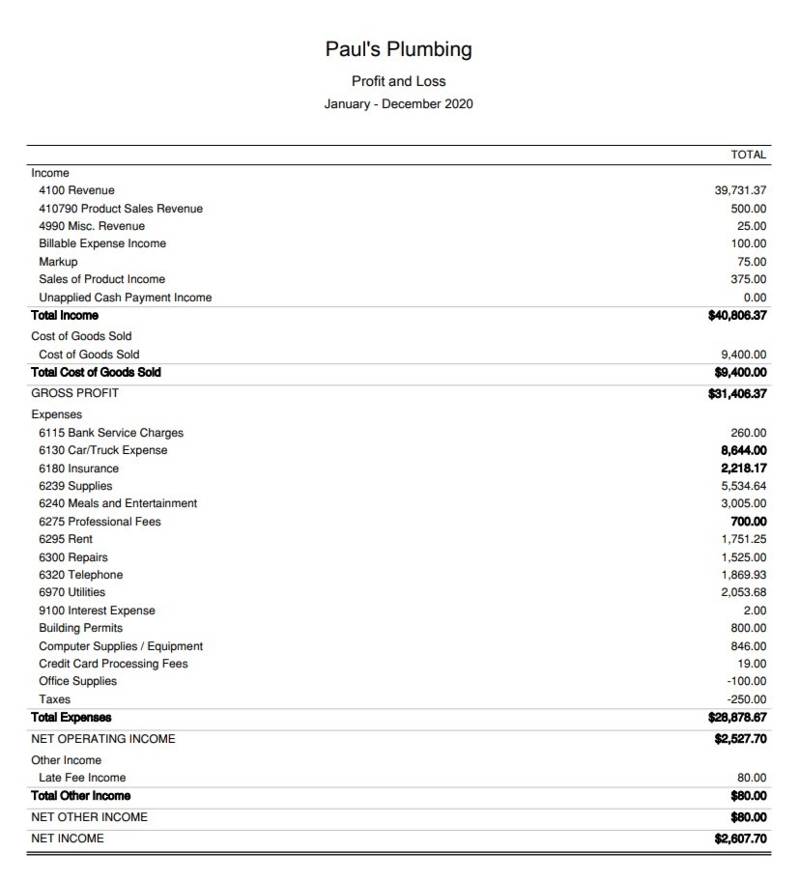

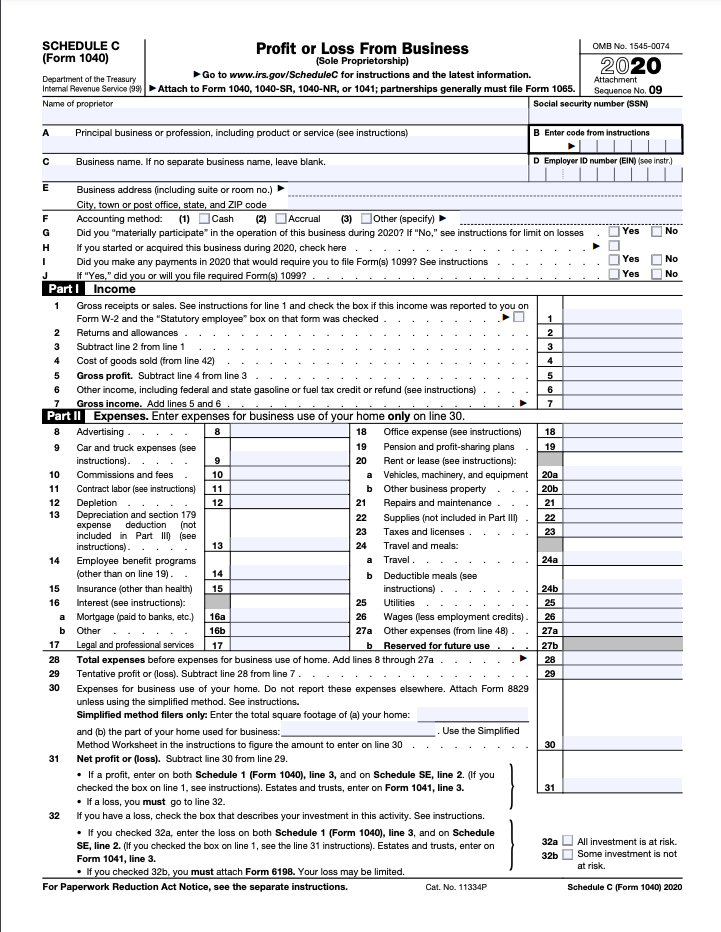

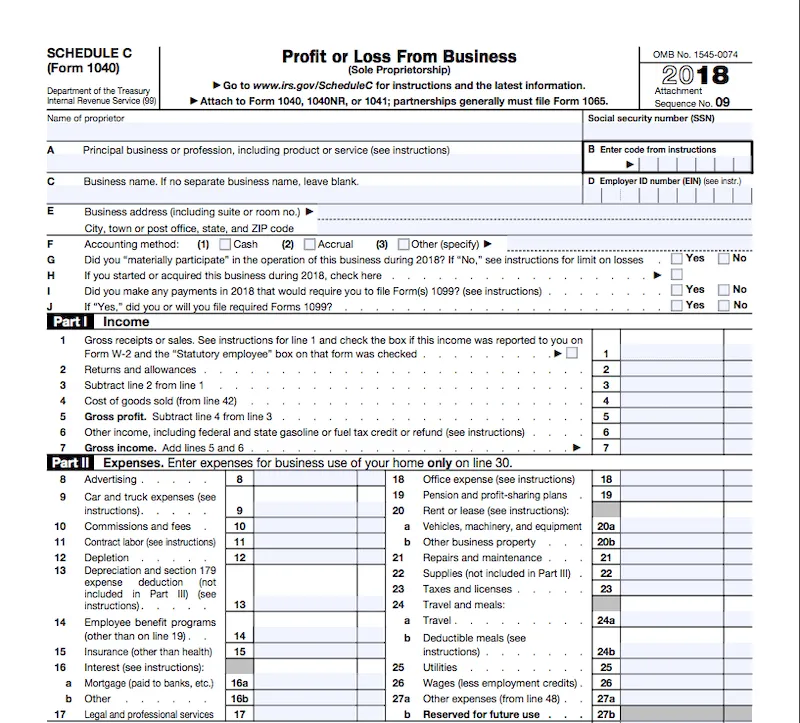

19 IRS Form W3Apr 04, 18 · Schedule C Form As an independent contractor, one of your responsibilities is to mark all expenses and income you handle under the label 'selfemployed' Combine the data that you used in the 1099K and 1099MISC Then, use this data to fill out the Schedule C Form Schedule SE Once you have completed Form Schedule C, the next step is toDec 12, 17 · The Schedule C form helps anyone who is self employed calculate the profit (or loss) of the business for annual taxes, which are due on April 15 A Schedule C form has two general parts earnings and expenses Under the earnings category, you will see "Gross receipts or sales," which refers to all the money flowing into the business

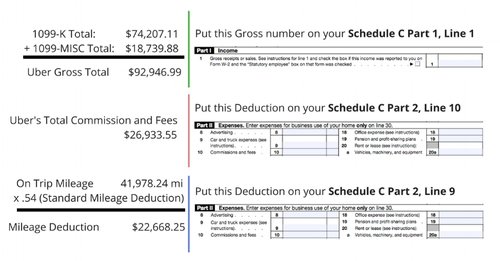

An independent contractor or selfemployed individual should report income on Schedule C Profit or Loss From Business You may need to file other schedules and forms, including Schedule SE for selfemployment tax on income from a trade or business You must report all income, even if you did not receive a Form 1099MISCAlso file Schedule SE (Form 1040), SelfEmployment Tax if net earnings from selfemployment are $400 or more This form allows you to figure social security and Medicare tax due on your net selfemployment incomeMar 08, 21 · Gig workers should use their 1099s to calculate gross receipts (see box 1a on 1099K's and box 1 on 1099NEC's) Some companies, like Uber, may provide a helpful tax summary of gross receipts • Lines 26 includes returns, allowances, cost of goods, and other income They do not include expenses (that's in Part 2 of the Schedule C)

Apr 24, · How do I get a 19 1099 Schedule C w/o filing?Feb 24, 21 · Income earned as an independent contractor is typically reported with the contractor's Form 1040 on a Schedule C The total amount of all income reported on 1099MISC forms is included on Line 1Form 1040, Schedule C, is also used to report wages and expenses the taxpayer had as a statutory employee or certain income shown on Form 1099MISC or Form 1099NEC Some employers misclassify workers as independent contractors and report their earnings on Form 1099MISC or Form 1099NEC

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at11.57.10AM-8cc0d5ec189e43f7a9c6ff164db34d2c.png)

Form 1099 K Payment Card And Third Party Network Transactions Definition

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide For Independent Contractors

Apr 01, 21 · A 1099 Contractor is a name given to selfemployed individuals who trigger the need for a company to issue a Form 1099MISC to document earnings paid to this person for services rendered, beyond $599 An independent contractor is a nonemployee of the companyIf you are selfemployed, an independent contractor (1099) or gig worker, filed a PUA claim before January 3, 21 and worked for the entire year of 19, you do NOT need to provide TWC with your complete 19 IRS tax return including Schedule C, F or SE unless your net profit for 19 exceeded $,800Jan 09, · If you receive a 1099, you will most likely be required to file a Schedule C and a Schedule SE Schedule C Despite popular belief, this schedule is not just for small business owners If box 7 on Form 1099MISC has an amount for nonemployee compensation, you will need to report this income on this schedule

How To Fill Out Schedule C If You Re Self Employed 17 Youtube

What Is Irs Schedule C Business Profit Loss Nerdwallet

Sep 15, · The first section on Schedule C asks whether you made any payments subject to filing a Form 1099 You must file a 1099 form for every contract employee to whom you paid $600 or more during theYou reported the amount as gross income of a business on the federal Schedule C (Form 1040), Part I, line 7 Schedule CA (540NR), you will report the amount as wages on Part II, Section A, line 1, Column C You reported the amount as business income on federal Schedule 1 (Form 1040Feb 01, 21 · IMPORTANT PPP UPDATE As of March 3, 21, applicants who report their income with IRS Form 1040 Schedule C (ie, most independent contractors, sole proprietors, and 1099 workers) will be able to use their GROSS (instead of net) profits to determine their max loan amount

Freelancers Meet The New Form 1099 Nec

What Are The Required Documents For A Ppp Loan Faq Womply

Mar 15, 21 · An independent contractor may also be referred to as a 1099 employee, which refers to the tax form provided at the end of the year Contractors who earn at least $600 from a client or company will receive a 1099MISC form from that client or company, which outlines the total income received for the calendar yearJan 04, 21 · Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship);Jan 31, 21 · The Schedule C will need to include information about the type of work that you do for the income reported on Form 1099NEC If you are working as an independent contractor, then you are running your own business performing the services or providing the goods for your income

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

Just like with the Form 1099MISC, the Form 1099NEC is not used to report payments of less than $600 over the course of a year If a client business pays the independent contractor less than $600 they are still required to report the income to the IRS, it is just that the client is not required to issue a Form 1099Mar 11, 21 · 1099 contractor form If you weren't selfemployed, your employer would send you a W2 form that lists your income and all the deductions that were withheld from your pay throughout the year, including federal, state, Social Security and Medicare taxesIt includes your income, your deductions, and details about yourself and your business

How To Apply For A Ppp Loan If You Re Self Employed Nav

What Is An Irs Schedule C Form And What You Need To Know About It

Mar 16, 21 · Generally, if you're an independent contractor you're considered selfemployed and should report your income (nonemployee compensation) on Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship) Most selfemployed individuals will need to pay selfemployment tax (comprised of social security and Medicare taxes) if theirForm 1099K is the IRS form that taxpayers receive to report certain payment transactions If you're selfemployed or an independent contractor, you report 1099K income on Schedule CMar 16, 21 · It's another story for freelancers and independent contractors who have their income reported on Forms 1099 If you are earning Form 1099 income you need to know your income tax bracket because you do not have the benefit of employer withholding and must send estimated tax payments to the IRS each quarter

1099 Misc Form Fillable Printable Download Free Instructions

Your Ultimate Guide To 1099s

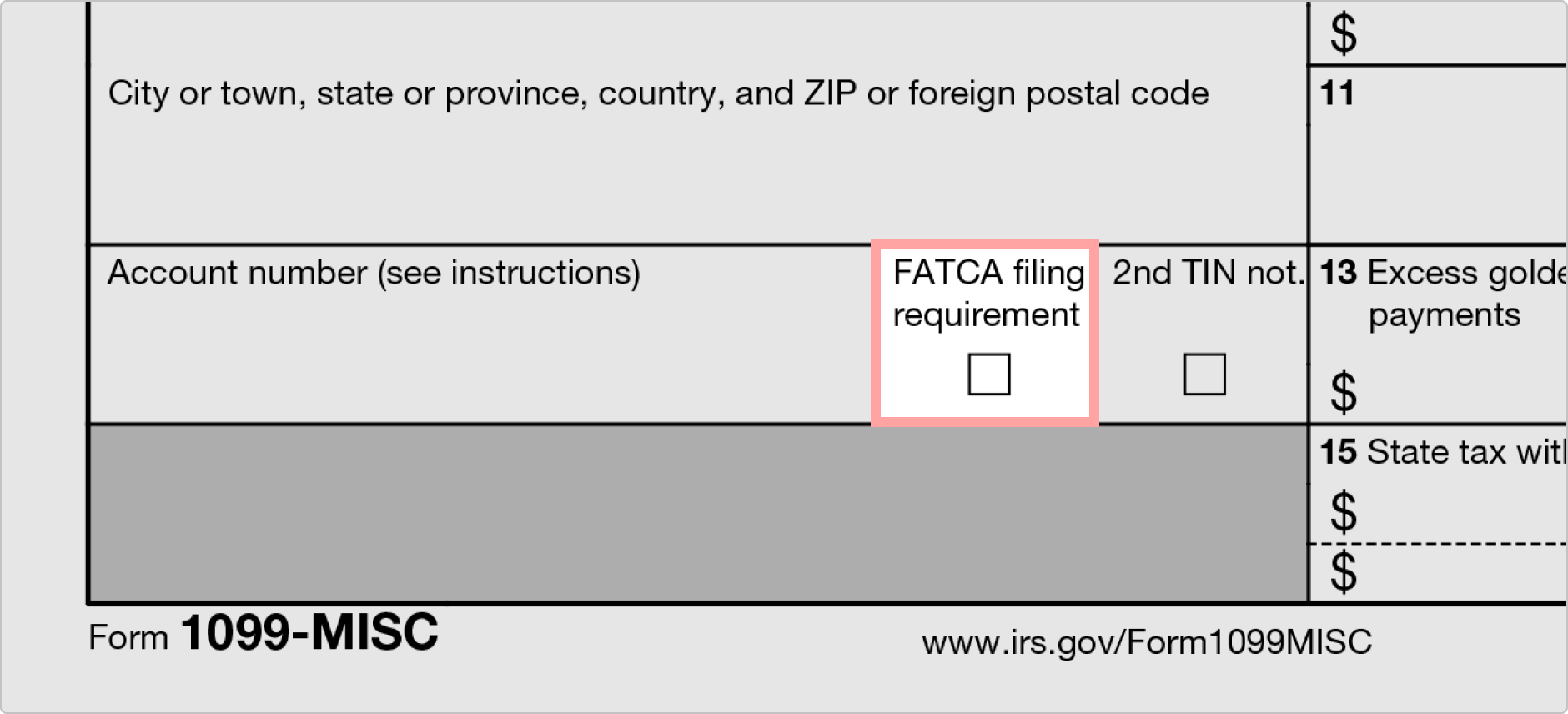

Documents you need if you're in business is a sole proprietorship, independent contractor, selfemployed, singlemember LLC If you have employees, you will need to provide the following Note Contractors issued a 1099 are not considered employees Copy of government issued ID (color copy front and back) 19 1040 Schedule C;22 Best 1099 Deductions for Independent Contractors With the freedom to organize your business comes the challenge of tracking expenses and deductions It can be overwhelming to find the right 1099 deductions to claim that will reduce your federal income tax billJul 23, · Companies use Form 1099NEC to report income earned by people who work as independent contractors rather than regular payroll employees Here is the form The IRS requires businesses to mail a 1099 form directly to the independent contractor, so that the IRS can predict how much tax revenue to expect from selfemployed individuals

Form 1099 Schedule C Business Expenses Blog Taxbandits

What Small Business Owners Need To Know About Stimulus Loans

The Schedule CEZ stands for Net Profit from Business while the regular ScheduleC stands for Profit and Loss from Business If you made some income from your business and didn't have any qualified 1099 business tax deductions, then you best file a Schedule CEZ This filing form is simpler than the regular Schedule C because you use it toJan 05, · Independent contractors use the Schedule C form to report business income If you're a 1099 contractor or sole proprietor, you must file a Schedule C with your taxes Your Schedule C form accompanies your 1040 and reports business income, expenses, and profits orJan 26, 21 · Read more about the latest 1040 Schedule C/PPP loan rules changes, and see the new rules, and the new PPP application form for Schedule C applicants We're very excited to have the opportunity to talk to an SBA expert about common questions independent contractors, sole proprietors, and selfemployed individuals have about the PPP program

:max_bytes(150000):strip_icc()/Form1099-aeb4be046fe64c148a594971594ece90.png)

What Is Form 1099

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

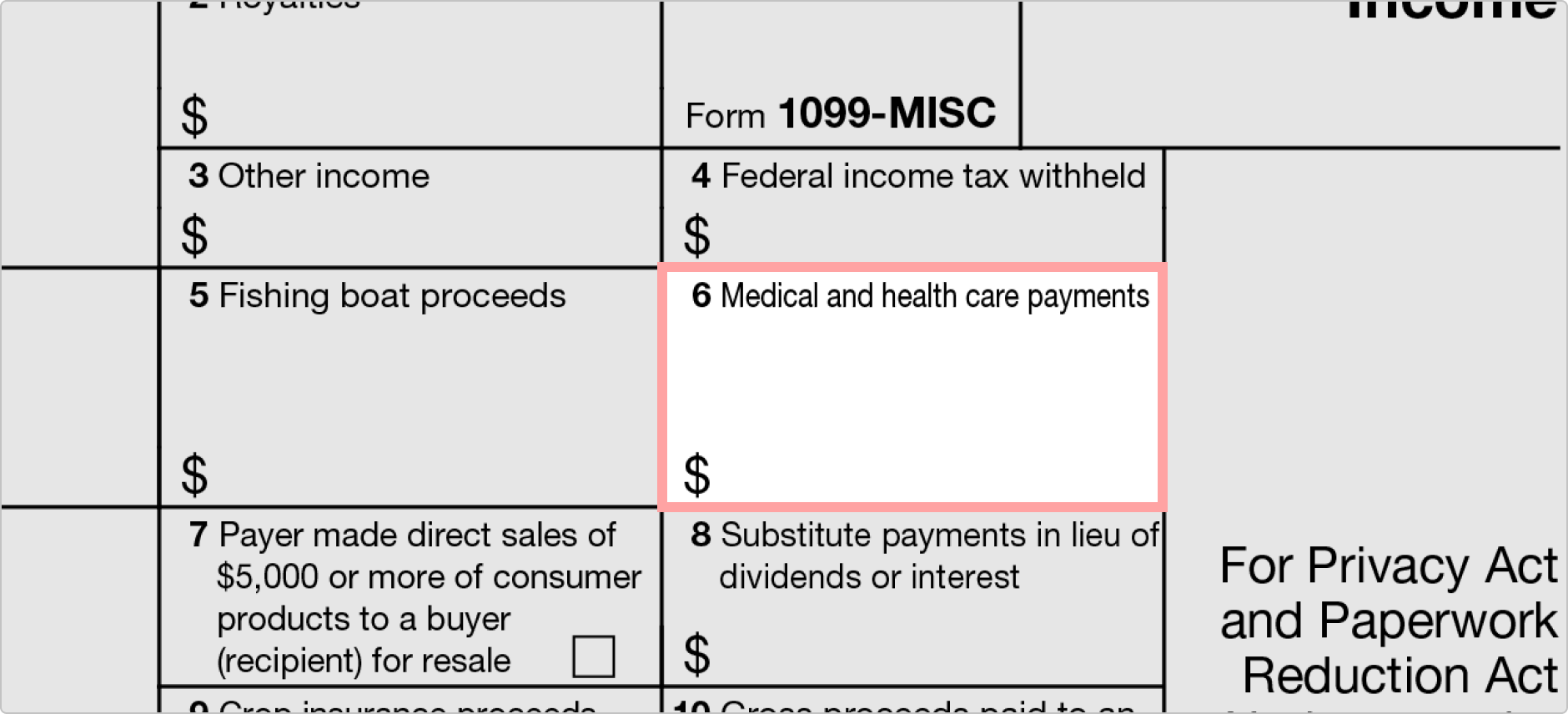

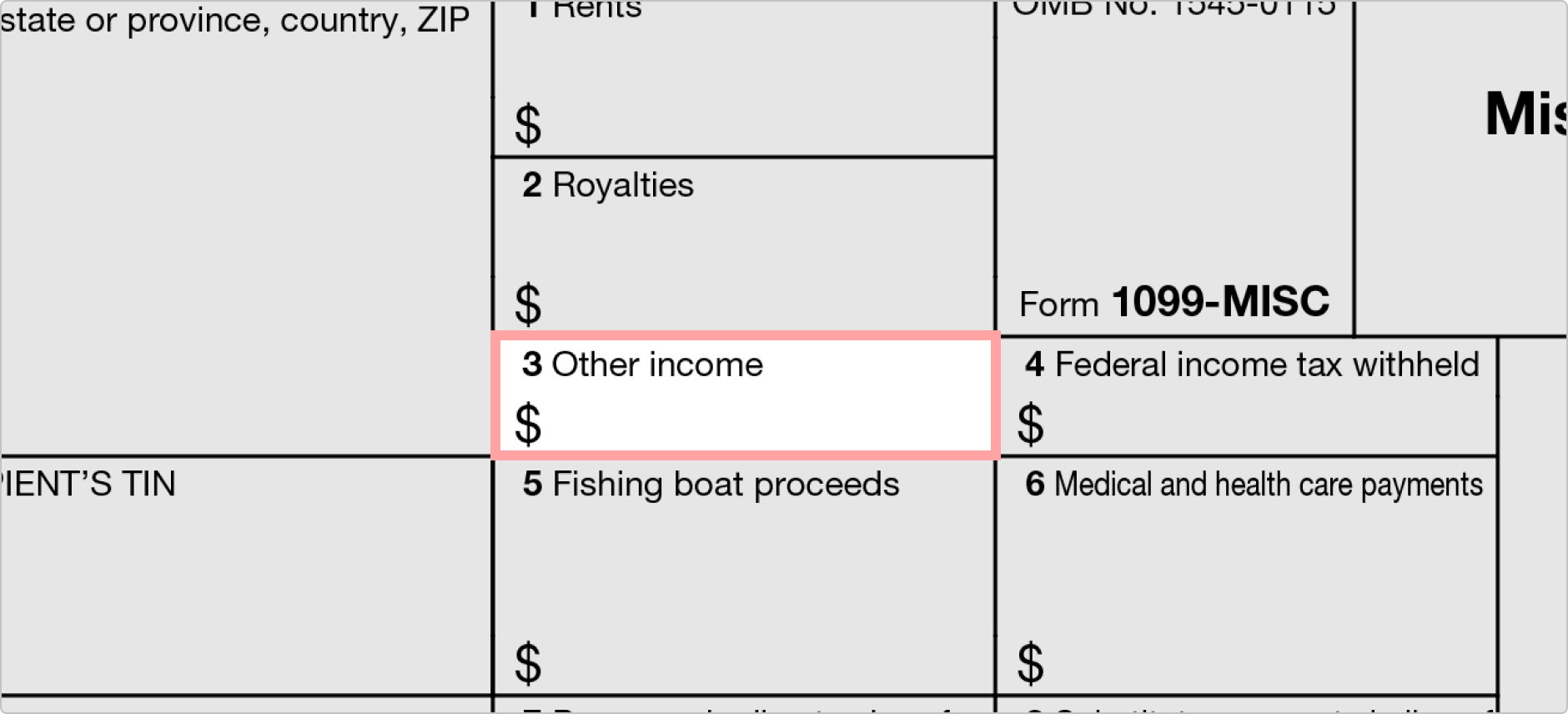

Jan 24, 21 · The Independent Contractor Tax Form The Full Guide The 1099 form is a record stating how much an independent contractor earned from their clients There are several variations to the 1099 form, but the most common one is the 1099MISC Here are the different scenarios where an independent contractor may receive a 1099 form From clients orJan 28, 21 · The Form 1099MISC is for each person to whom the taxpayer has paid the following during the course of a trade or business •At least $10 in royalties or broker payments in lieu of dividends or taxexempt interest,Jun 17, · Step 1 Enter the Gross Earnings (Box 1) amount from your Form 1099MISC onto your Schedule C form (Form 1040 or 1040SR) Your Schedule C (Form 1040 or 1040SR) will look something like this If you are using a Tax Pro

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

What Is A Statutory Employee Definition And Examples

Schedule C form 1040 for Sole proprietor, Independent contractor, Single Member LLC, PPP loan Forgiveness EIDL, Schedule C (Form 1040)How to fill out a 1040Jul 08, · Forms 1099 and W2 are two separate tax forms for two types of workers Independent contractors use a 1099 form, and employees use a W2 For W2 employees, all payroll taxes are deducted automatically from the paycheck and paid to the government by the employer Contractors are responsible for paying their own payroll taxes and submitting themMar 19, 19 · Payers use Form 1099MISC, Miscellaneous Incometo Report payments made in the course of a trade or business to a person who's not an employee or to an unincorporated business Report payments of $10 or more in gross royalties or $600 or more in rents or compensation

:max_bytes(150000):strip_icc()/Schedule-C-1040-Form-b15a78b583c04e4b80c96ff1d0fee048.png)

What Is Schedule C On Form 1040

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Apr 01, 21 · OK, I'm completing my 1040, and turbo tax is flagging an item on my schedule c In 16, I worked as an independent contractor teacher/education services I also worked as a salaried teacher at a school Line 1e is asking me for W2 information but my W2 was for my salaried job All my contractor work money was stated on 1099 MISCNo form received for federal;May 07, 21 · Independent Contractor Income compensation you receive for doing work or providing services as a selfemployed individual, not as an employee If you are selfemployed and an independent contractor, your compensation is reported on Form 1099MISC or Form 1099NEC (along with rents, royalties, and other types of income) If you received a 1099

/SchedF-0ace017c310b43189a3050710d298e4c.jpg)

Schedule F Form Profit Or Loss From Farming Definition

Walk Through Filing Taxes As An Independent Contractor

Mar 03, 21 · IMPORTANT PPP UPDATE As of March 3, 21, applicants who report their income with IRS Form 1040 Schedule C (ie, most independent contractors, sole proprietors, and 1099 workers) will be able to use their GROSS (instead of net) profits to determine their max loan amount

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

A 21 Guide To Taxes For Independent Contractors The Blueprint

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Doordash Taxes Schedule C Faqs For New Experienced Dashers

Understanding Your Instacart 1099

1099 Misc Form Fillable Printable Download Free Instructions

1099 Misc Form Fillable Printable Download Free Instructions

Freelancers Meet The New Form 1099 Nec

Irs Schedule C What It Is And When To Use It Rethority Real Estate Guides News And More

Cryptocurrency Tax Reporting How To Pay Tax On Crypto Tokentax

:max_bytes(150000):strip_icc()/MiscellaneousIncome-dff90d4dcb754dd1a08e153167070669.png)

Irs Form 1099 Misc What Is It

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

What You Need To Know About Instacart 1099 Taxes

Form 1099 Misc Vs Form 1099 Nec How Are They Different

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

What Do The Expense Entries On The Schedule C Mean Support

:max_bytes(150000):strip_icc()/Form1040-651873f7a52b48edad115da1b595ad00.jpg)

Other Income On Form 1040 What Is It

Irs Schedule C What It Is And When To Use It Rethority Real Estate Guides News And More

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

Instructions For Forms 1099 Misc And 1099 Nec 21 Internal Revenue Service

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

1099 Excel Template

How To Fill Out Schedule C For Business Taxes Youtube

How To File Taxes For 1099 Forms Independent Contractors

Ppp Faqs 1040 Schedule C Tips For Independent Contractors Sole Proprietors And Self Employed

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Independent Contractor Taxes Guide 21

Schedule C Self Employment Covered Ca Subsidies Home Office Hobby

How Much In Taxes Do You Really Pay On 1099 Income Taxhub

What Is A Schedule C Stride Blog

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

Understanding Your Doordash 1099

Step By Step Instructions To Fill Out Schedule C For

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart

Independent Contractor 101 Bastian Accounting For Photographers

Irs Schedule C 1040 Form Pdffiller

1099 Misc Business Expenses For Independent Contractors Employee Or Independent Contractor

Form Irs 1040 Schedule C Fill Online Printable Fillable Blank Pdffiller

What Is Irs Schedule C Business Profit Loss Nerdwallet

1099 Misc Form Fillable Printable Download Free Instructions

Form 1099 Nec For Nonemployee Compensation H R Block

How Couriers File Their Taxes All Your Food Delivery Tax Questions Answered Courier Hacker

Ppp Application Guide For Gig Workers Self Employed Sba Ppp Loan

How To Prepare A Schedule C 10 Steps With Pictures Wikihow

How To Fill Out The Schedule C

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Schedule C Do Taxes

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

A 21 Guide To Taxes For Independent Contractors The Blueprint

How To File For Taxes As A 1099 Worker Form Pros

Doordash 1099 Taxes And Write Offs Stride Blog

Top Ten 1099 Deductions Stride Blog

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Tax Documents That Every Freelancer And Contractor Needs Form Pros

Self Employed And Taxes Deductions For Health Retirement

Schedule C Form 1040 Sole Proprietor Independent Contractor Llc Ppp Loan Forgiveness Schedule C Youtube

How To Prepare A Schedule C 10 Steps With Pictures Wikihow

Tax Deductions For Independent Contractors Kiplinger

Filing A Schedule C For An Llc H R Block

The Ultimate List Of Self Employment Tax Deductions In Gusto

Step By Step Instructions To Fill Out Schedule C For

1040 Statutory Employees Schedulec Schedulese W2

Uber Tax Filing Information Alvia

How To File Schedule C Form 1040 Bench Accounting

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

Walk Through Filing Taxes As An Independent Contractor

How To Fill Out Schedule C Grubhub Doordash Uber Eats Instacart

What Is Form 1099 Nec Turbotax Tax Tips Videos

Independent Contractor 101 Bastian Accounting For Photographers

A Friendly Guide To Schedule C Tax Forms U S Freshbooks Blog

I Dont Understand 1099 Misc Independent Contractor Please Save Me Turbotax

Self Employment 1099s And The Paycheck Protection Program Bench Accounting

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

How To Prepare A Schedule C 10 Steps With Pictures Wikihow

0 件のコメント:

コメントを投稿