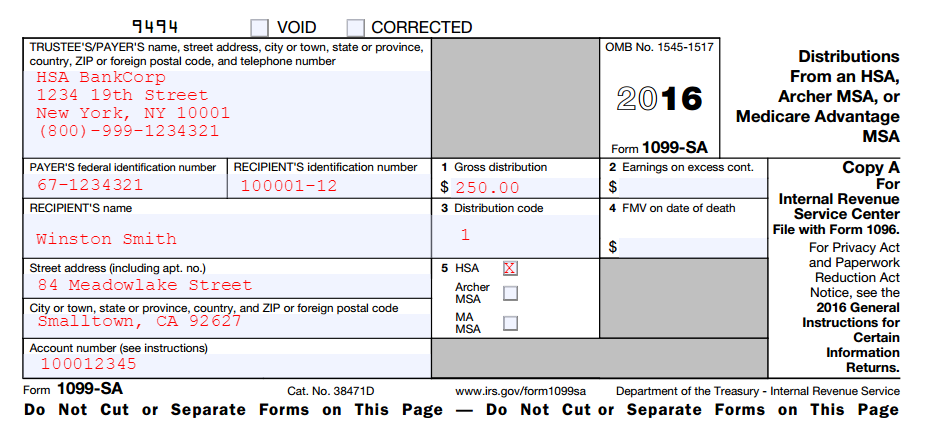

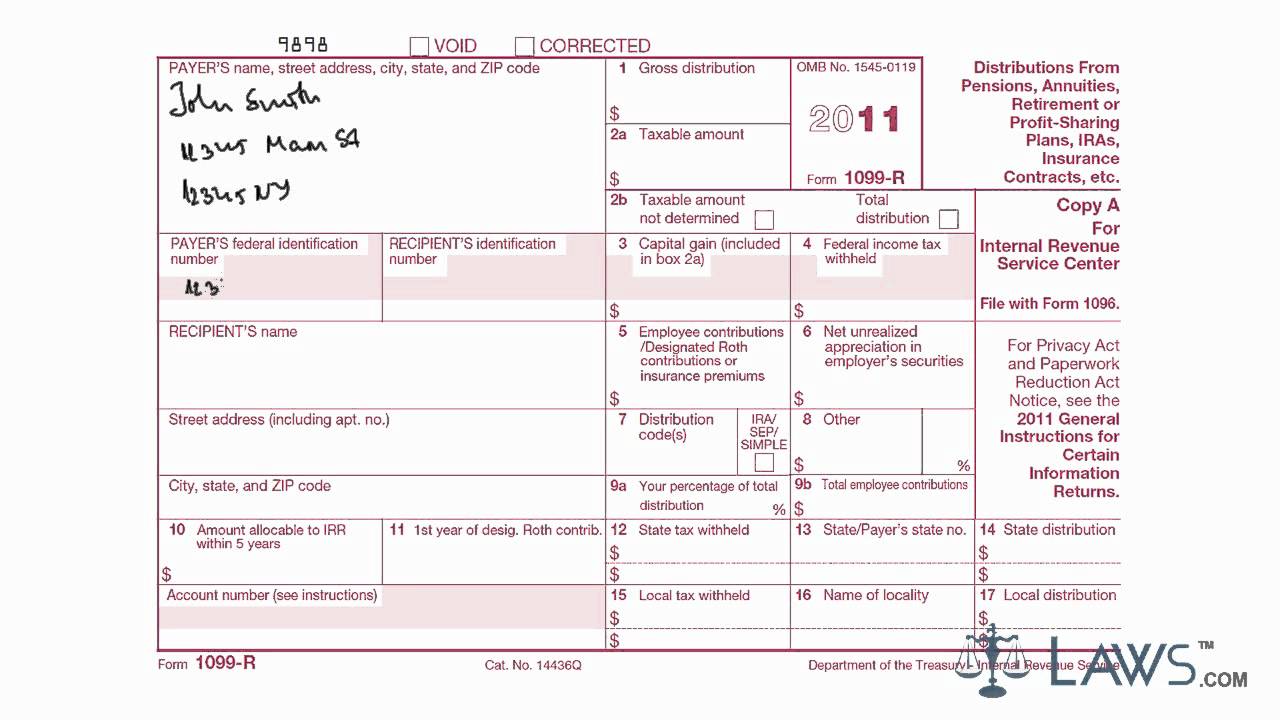

0502 · If you're one of over 44 million retired Americans, there's a good chance you've come across tax form 1099R In addition to completing your standard IRS Form 1040, you're required to complete form 1099R if you've received any distributions from profitsharing or retirement plans, IRAs, annuities, pensions, and more · Form 1099SA, Distributions From an HSA, Archer MSA, or Medicare Advantage MSA You should expect a copy of Form 1099SA by January 31 if you used money in a health savings account (HSA), Archer MSA, or Medicare Advantage MSA The account administrator is responsible for sending your form Use the information on a 1099SA to complete Form · Each form 1099 must be completed in electronic and paper format (PDF) The electronic file must be prepared in a text file (txt) according to the rules defined for each year by the IRS This file need to be reported to IRS

Form 1099 R Wikipedia

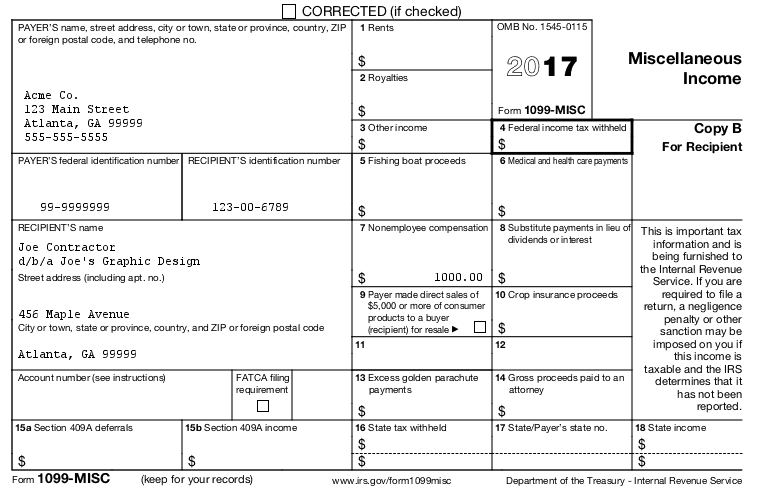

1099 completed form

1099 completed form-It turns out that every successful sweeper in the United States needs to know a little bit about 1099 forms Why you need them, how they work, and when you can expect to receive themHow to fill Form 1099B Complete blanks electronically working with PDF or Word format Make them reusable by generating templates, include and fill out fillable fields Approve documents with a legal electronic signature and share them by way of email, fax or print them out Save documents on your PC or mobile device Improve your productivity with powerful service?

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

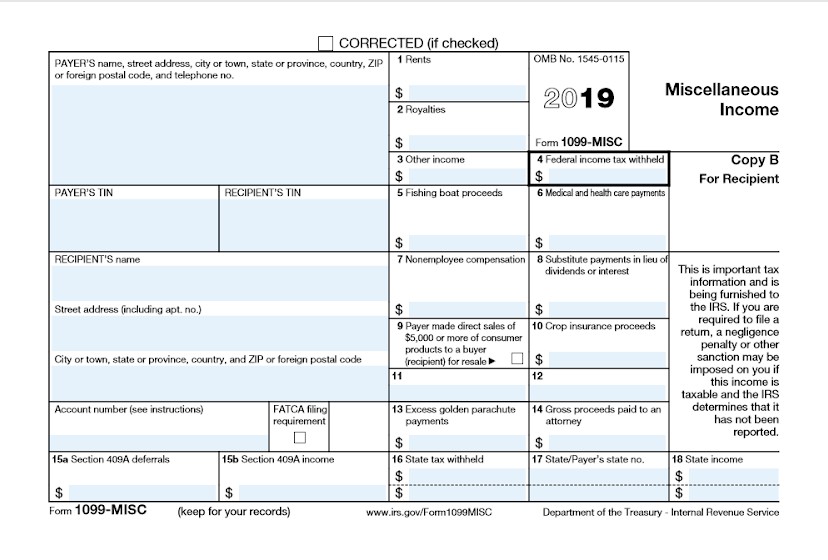

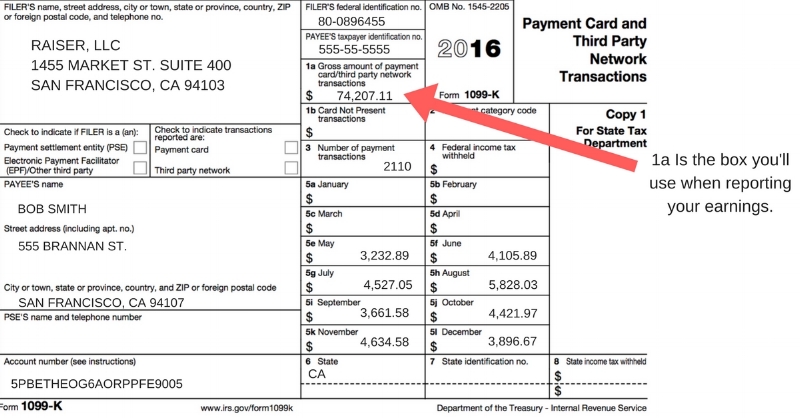

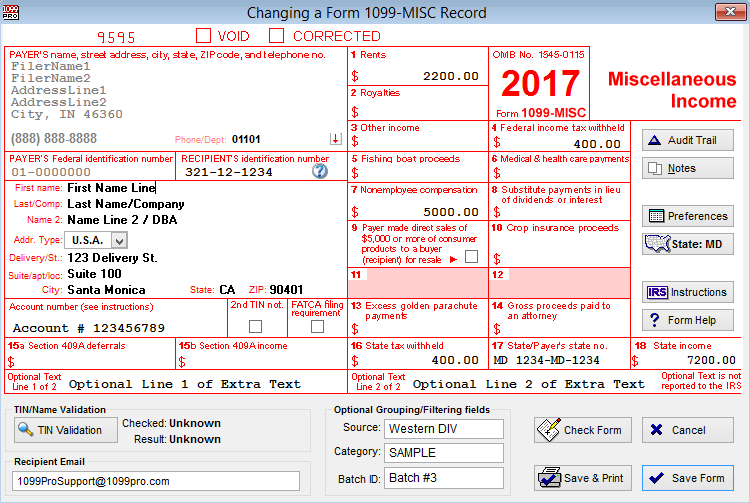

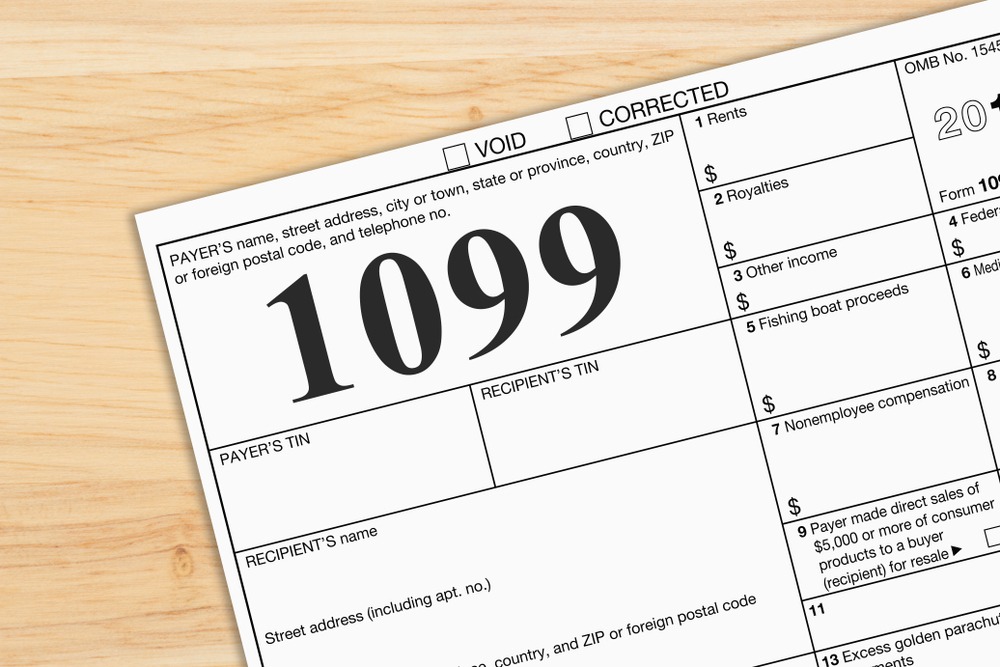

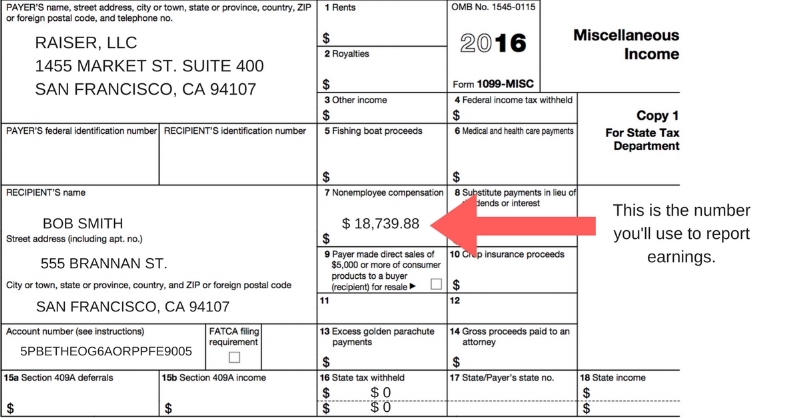

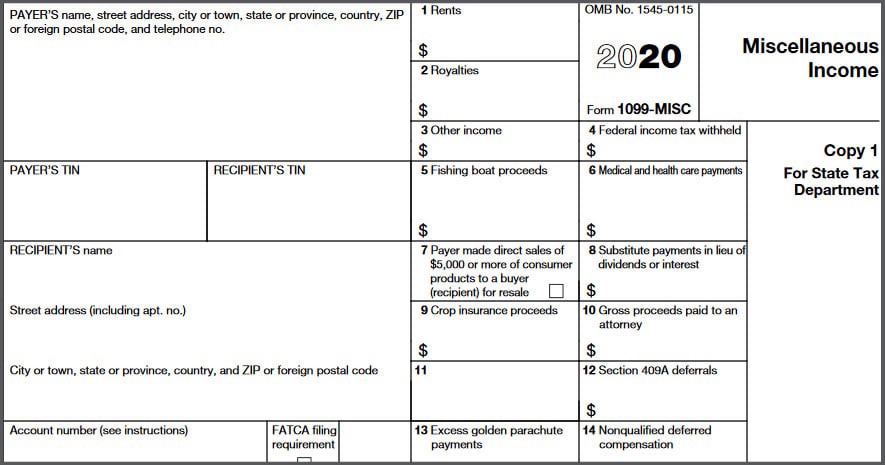

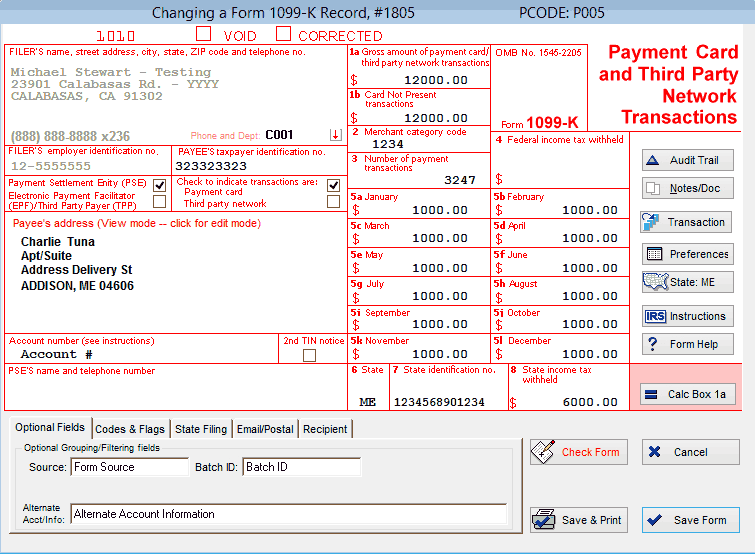

· The 1099MISC Form should not be confused with the Form 1099K, which is required to report thirdparty networks or vendors that process payments The 1099K Form is used to record payments processed through these credit card payment companies, documenting any fees incurred as well · The Statement for Recipients of Certain Government Payments (1099G) tax forms are now available for New Yorkers who received unemployment benefits in calendar year This tax form provides the total amount of money you were paid in benefits from NYS DOL in , as well as any adjustments or tax withholding made to your benefits0311 · Form 1099MISC, Miscellaneous Income, is an information return businesses use to report payments and miscellaneous income File Form 1099MISC for each person you have given the following types of payments in the course of your business during the tax year At least $10 in royalties or broker payments in lieu of dividends or taxexempt interest

Quick steps to complete and esign 1099 R Form online Use Get Form or simply click on the template preview to open it in the editor Start completing the fillable fields and carefully type in required information Use the Cross or Check marks in the top toolbar to select your answers inIncome Select My Forms;The form samples include samples for preprinted as well as BIP versions of the 1099 forms You use the preprinted version ZJDE0001 for printing the form output on the office supply stock of 1099 forms where you only create the data on the already printed form However, when you use the BIP version, the system creates the entire form as well as the

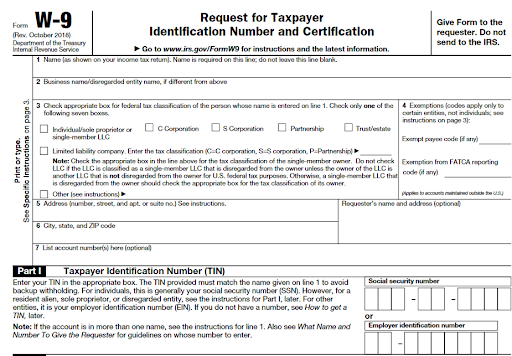

You can also ask the seller to complete IRS Form W9 as part of their closing package, which will include all the information that is needed to complete a 1099S If you fail to get a W9 or include a designation clause in the purchase agreement, you can put together a letter of instruction and send it to the seller with all the forms they will need to complete and submit it to the IRSMiscellaneous Income 1099MISC 2up Federal Copy A form Order the quantity equal to the number of recipients for which you file Plus FREE SHIPPING to the continental 48 states IMPORTANT You may need to use the new 1099NEC form with or instead of the 1099MISC!Then contact the Form 1099G state issuing agency immediately, and request a revised Form 1099G showing you did not receive these benefits and make sure you don't report them on your tax return Remember, with TurboTax, we'll ask you simple questions about your life and help you fill out all the right tax forms

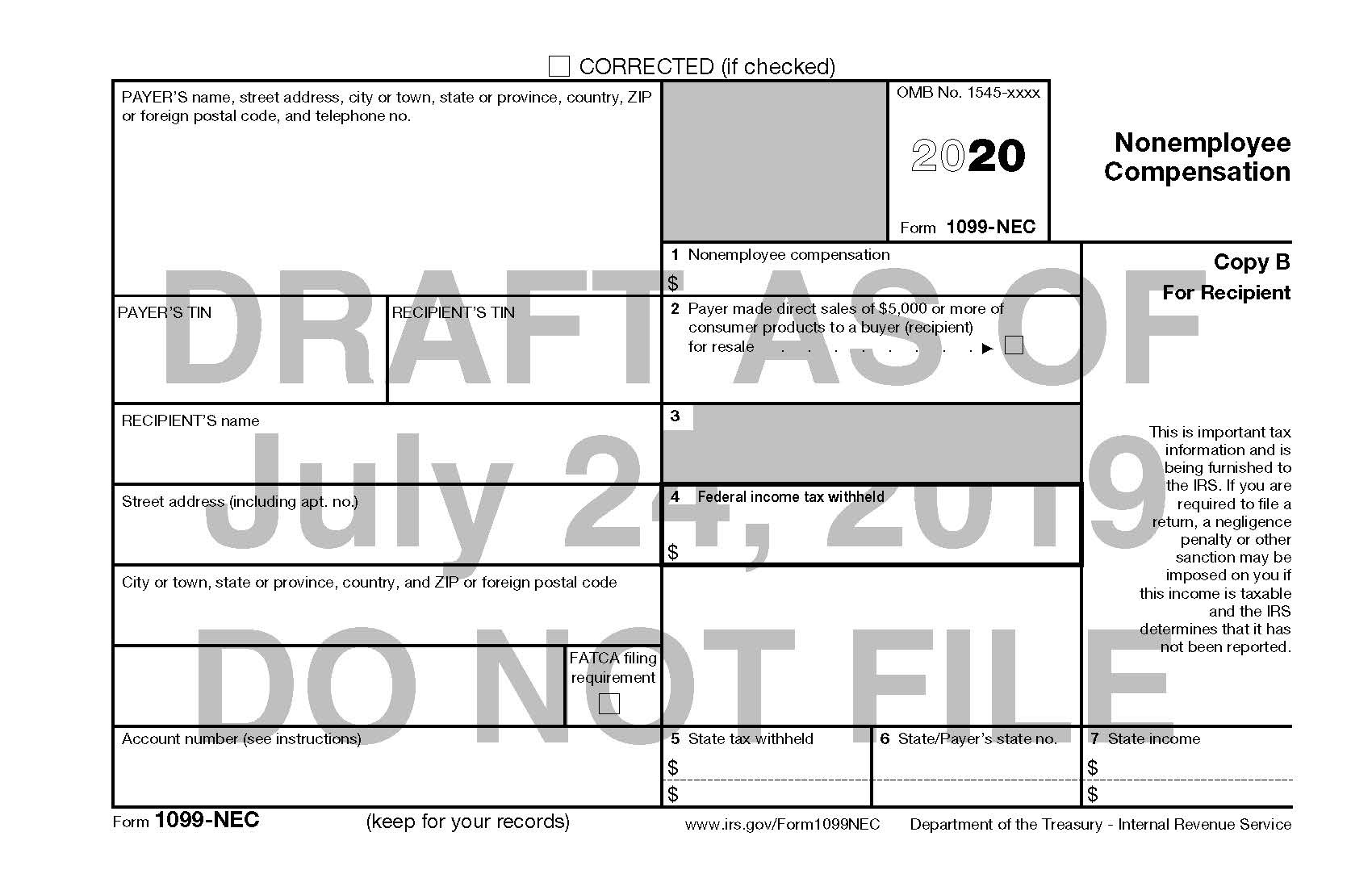

1099 Nec Software To Create Print E File Irs Form 1099 Nec

An Employer S Guide To Filing Form 1099 Nec The Blueprint

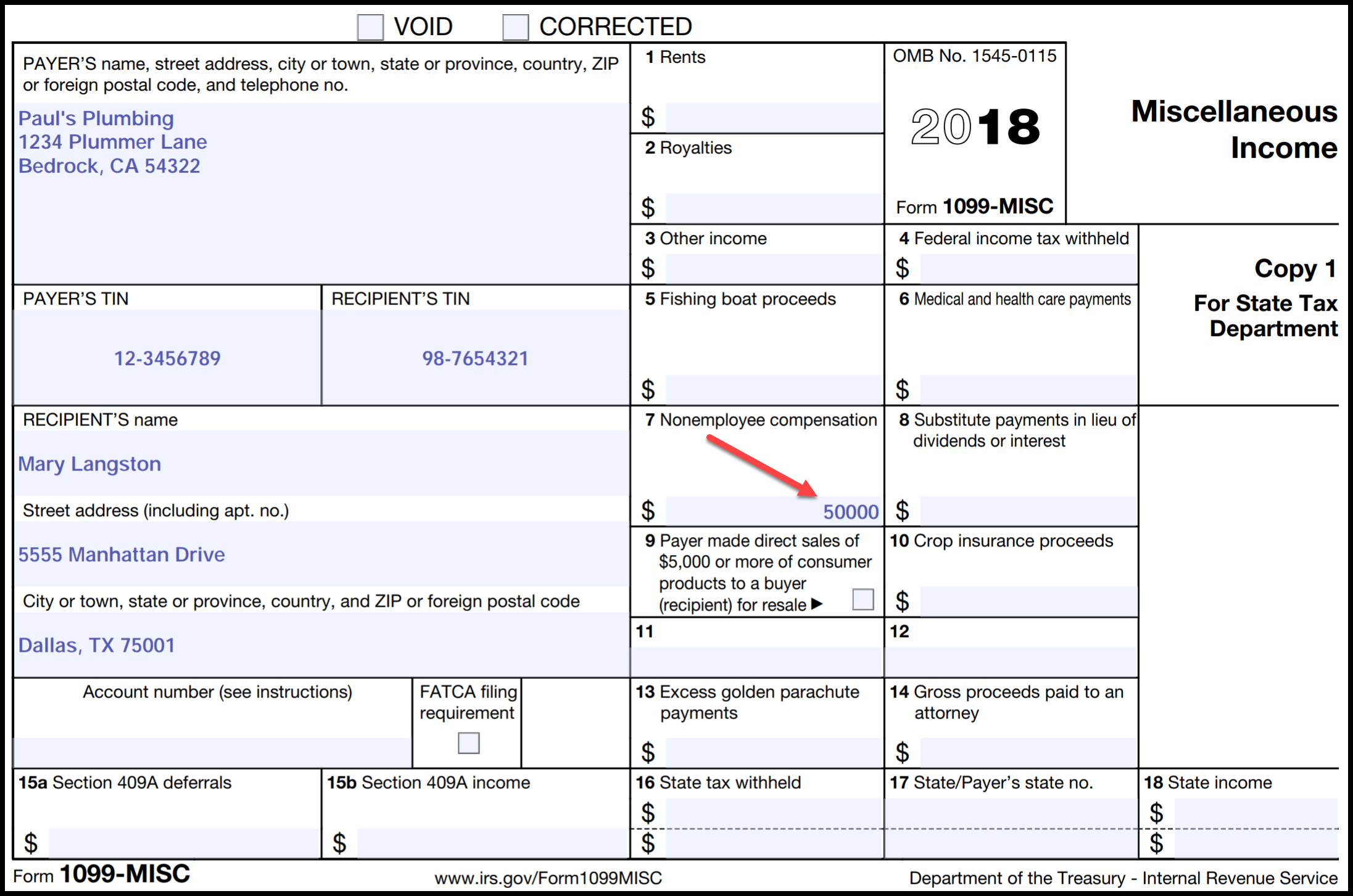

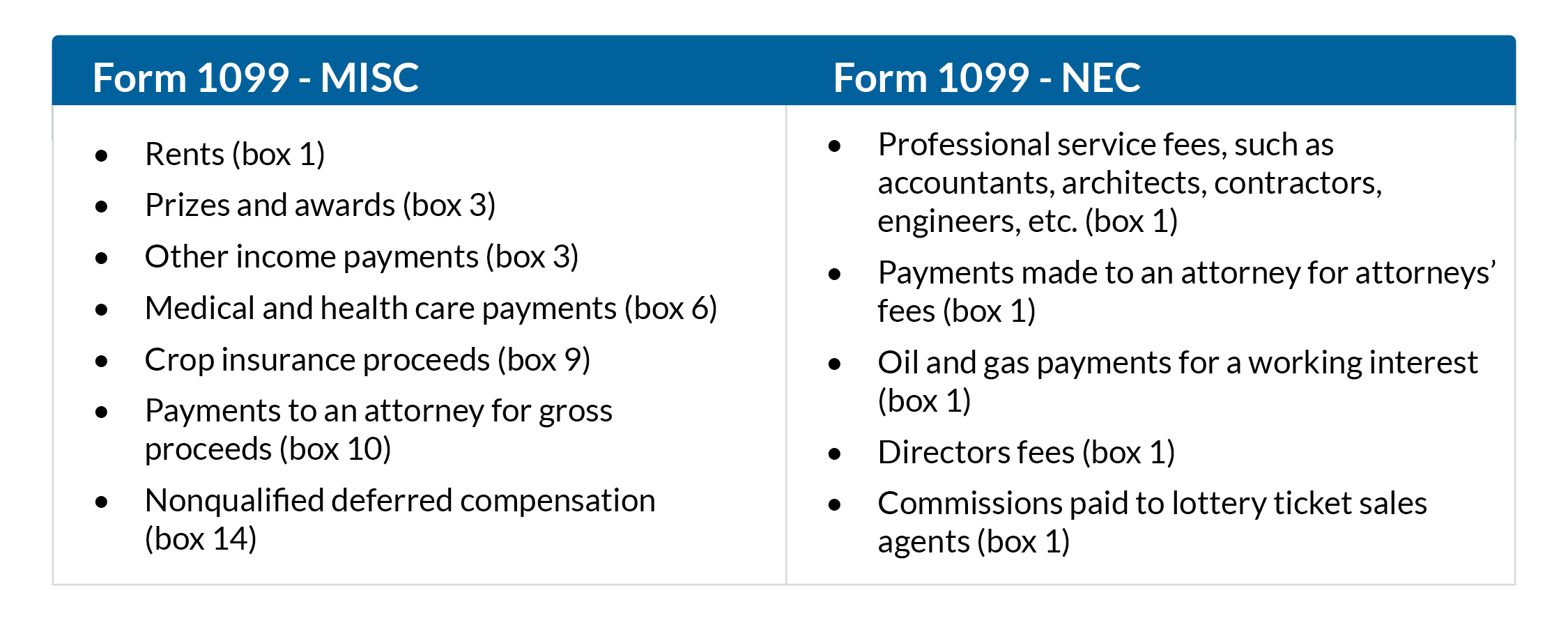

0112 · Forms 1099 are information returns that businesses use to report certain payments There are two types of 1099 forms Form 1099MISC and Form 1099NEC Between 19 – , businesses used Form 1099MISC for all 1099 reporting But in , the IRS revived Form · A 1099 form is a tax document filed by an organization or individual that paid you during the tax year "Employees get W2s This is the equivalent of a · 1099 Rules For Business Owners in 21 (updated 1/29/21) Over the past few years, there have been a number of changes and updates regarding the reporting rules for the mysterious 1099 Forms I say "mysterious" because many business owners simply guess as to what the rules are and oftentimes get exasperated and just give up choosing to file nothing at all

Irs 1099 Misc Form Pdffiller

How To Fill Out And Print 1099 Misc Forms

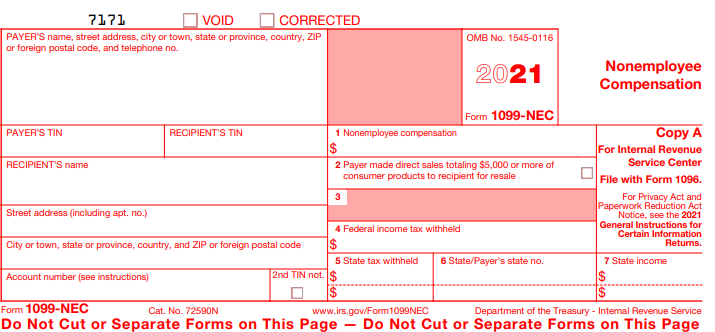

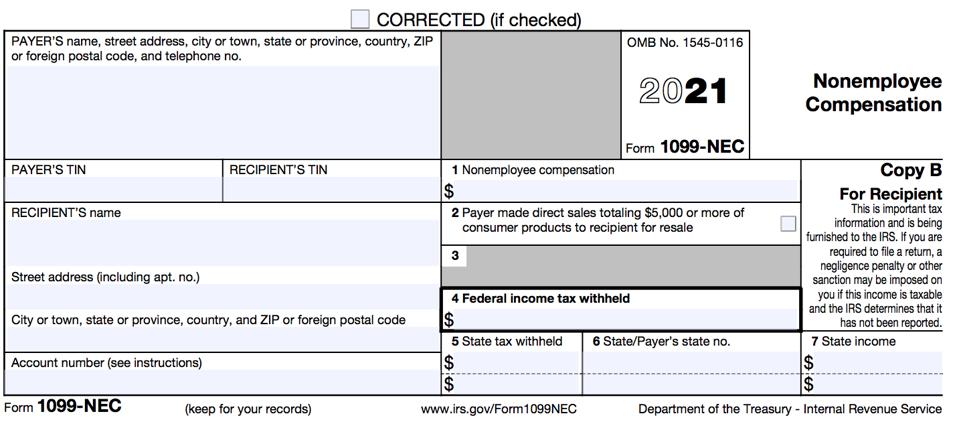

· Form 1099A Reports the "acquisition or abandonment of secured property"This basically means that you walked away from property, relinquishing it to the lender in lieu of paying a debt You'll receive this form even if you gave up some, but · Before you fill out a 1099MISC form, ensure that you order Form 1099MISC online or by phone Payer and recipient information In the unnumbered boxes on the top of the form, specify your business' name, street address, city or town, state or province, country and ZIP code and telephone numberForm 1099NEC as nonemployee compensation Any amount included in box 12 that is currently taxable is also included in this box This income is also subject to a substantial additional tax to be reported on Form 1040, 1040SR, or 1040NR See the Instructions for Forms 1040 and 1040SR, or the Instructions for Form 1040NR Boxes 15–17

Massachusetts Form 1099 Hc Outsourcing 499 Ma Form 1099 Hc Software

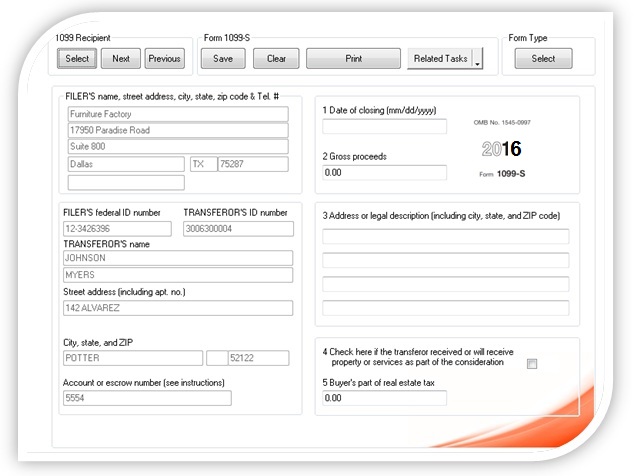

1099 S Software 19 1099 S Printing 1099 S Electronic Filing 1099 S Form Software

IRS Publication 1 A document published by the Internal Revenue Service that identifies a taxpayer's rights and outlines the processes followed by the IRS when it examines a taxpayer, issues a · Information reported on a 1099 Form is used to complete a person's 1040 Form as part of a federal tax return In the United States, corporations, small businesses and other employers use a variety of forms to record the income earned byThe easiest way to complete your 1099 forms is to use a payroll service For example, we've partnered with Gusto –and they automatically file all tax forms for you!

Irs Releases Form 1099 Nec Why The Fuss Grennan Fender

Irs 1099 Misc Vs 1099 Nec Inform Decisions

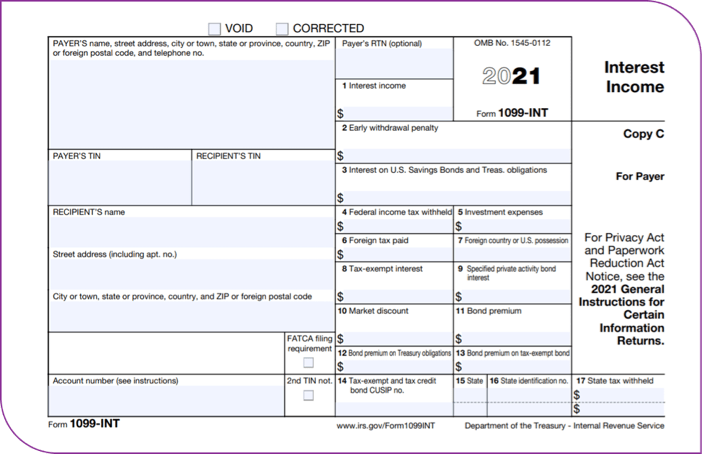

0217 · Examples of Completed SSA1099s Exhibit 3 shows how a SSA1099 looks when there is Worker's Compensation Offset and explains that Social Security benefits potentially subject to tax will include any workmen's compensation whose receipt caused any reduction in Social Security disability benefits1099 Sample Forms This appendix includes the following sample forms Appendix H, "1099 Miscellaneous Income (Updated for 1099)" Appendix H, "1099 Nonemployee Compensation" Appendix H, "1099 Dividends and Distributions (Updated for 1099)" Appendix H, "1099 Interest Income" These forms are for informational purposes onlyHiring a contractor can be a stressful job, but unfortunately your job is not done once you write that final check At the end of the year you may also need

/ScreenShot2020-02-03at12.03.51PM-3d211ba7a63743e3ba27359ab5691829.png)

Form 1099 Oid Original Issue Discount Definition

Fast Answers About 1099 Forms For Independent Workers Small Business Trends

However, if you'd rather do it yourself, you'll need to take several steps including gathering the needed information, sending a copy to the independent contractor, sending a copy to the IRS, and submitting Form 1096 if youCOMPLETE THE 1099S INPUT FORM ONLY IF APPLICABLE 1099S CERTIFICATION FOR 1099S REPORTING ON THE SALE OF A PRINCIPAL RESIDENCE This form may be completed by each seller of a principal residence to determine if no Form 1099S information reporting is required to be made to the Internal Revenue Service(EIN)) However, the issuer has reported your complete TIN to the IRS FATCA filing requirement If the FATCA filing requirement box is checked, the payer is reporting on this Form 1099 to satisfy its chapter 4 account reporting requirement You may also have a filing requirement See the Instructions for Form 38

New Irs Form 1099 Nec Takes Non Employee Compensation Out Of Misc Tax Practice Advisor

W9 Vs 1099 Irs Forms Differences And When To Use Them

1112 · While you may have heard the term "1099 employee," it's a misnomer a 1099 employee technically doesn't exist because employees are classified differently than independent contractors—and it's contractors who use the 1099 form 1099 contractors can often add just the extra burst of talent and speed you're looking for0807 · How to Complete and File Your 1099NEC Forms If you use independent contractors, you'll need to fill out the yearend 1099NEC form for each of them come tax time The Blueprint shows you how to1099 Form Choose the fillable and printable PDF template 1099 Create, complete and share securely Instantly send or print your documents Try now?

1099 Misc Form Fillable Printable Download Free Instructions

Amazon Com Complete 3 Part Laser 1099 Misc Tax Form Set And 1096 Kit For 50 Vendors Good For Qb And Accounting Software 1099 Misc Office Products

Form SSA1099 is used to report any Social Security benefits that you may have collected during the year To enter, go to Federal Section;Understanding Form 1099B and 49 CoinList is on a mission to make cryptocurrency taxes as seamless as possible CoinList provides all users that incurred a taxable disposition with a 1099B, which itemizes all known taxable transactions11 · When you hire a nonemployee, you must get a W9 form from them reporting this and other identifying information you'll need to complete Form 1099NEC Document your efforts to obtain a completed W9 form by keeping notes of the

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

What Is Form 1099 Nec For Nonemployee Compensation Blue Summit Supplies

If you completed more than one exchange, a different form must be completed for each exchange For linebyline instructions on how to complete form, download the instructions here It is very important that you file Form 84 along with your return, since your settlement agent will file a 1099S upon the sale of your propertyForms 1099 for other types of income (selfemployment, investment, social security, pension, stock sales, etc) Forms 1098 for certain expenses (education, mortgage interest, etc) Forms 5498 for retirement accounts You can't get last year's transcript until after the April filing due dateForm 1099MISC, for Miscellaneous Income, is a tax form that businesses complete to report various payments made throughout the year One Form 1099MISC should be filed for each person or nonincorporated entity to whom the business has paid at least $10 in royalties or at least $600 for items such as rent and medical or health care payments

The Ins And Outs Of Form 1099 Vrakas

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

· A 1099 is a document or a series of documents used by the IRS to track different types of income, other than salary, received from an employer At the end of each year, it is the responsibility of the person paying to provide a completed 1099 form to the person they paySample 1099NEC The 1099NEC is being introduced for tax year Previously, these amounts were reported on Box 7 of the 1099MISC To read a brief description of a box on the 1099NEC, move your mouse pointer over a box in the sample formWhat is Form SSA1099?

Form 1099 For Nonprofits How And Why To Issue One Jitasa Group

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

2800 · Form 1099 is completed by the employer and details the wages being paid to the contractor You must file Form 1099 with the IRS and your state tax authorities by Jan 31 of the following tax year2911 · What do boring tax forms have to do with the thrill of winning sweepstakes prizes?More than 70% of filers in 19 reported information in Box 7 of form 1099MISC

The New 1099 Nec Irs Form For Second Shooters Independent Contractors Formerly 1099 Misc Lin Pernille

4 Easy Steps To File Your 18 Form 1099 Borgida Cpas

· Check out our complete article on the IRS 1099 form reporting or download the 1099MISC instructions for more details When to Issue a 1099 You'll issue a 1099MISC form at yearend for any contractor who has earned $600 or more during the tax yearHow to Complete a 1099S To complete the filing process, you will need to order blank copies of IRS Form 1099S and IRS Form 1096 These forms need to be printed with a very specific type of paper and ink, and while it's possible to reproduce these documents from home, it's a lot easier to just order them from the IRS · Form 1099 Penalty Rates Updated on January 21, 21 1030 AM by Admin, TaxBandits A penalty will be charged if you fail to issue Form 1099 to the payee The amount of the penalty is based on when you file the correct information return or

Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

1099 Misc Software Software To Create Print And E File Form 1099 Misc

Form 1099 Step by Step Instructions on how to efile the Form 1099 is Taxable Income on your or 21 Tax Return May 17 is Due DateForm 1099MISC Get Form 1099MISC 1021 Get Form 1099form19com is not affiliated with IRS1099R, RRB1099, RRB1099R, SSA1099 Distributions from pensions, annuities, retirement, IRA's, Social Security, etc

1099 Printing Software Form 1099 Filing Software

Form 1099 Nec Instructions And Tax Reporting Guide

1612 · A 1099 is an "information filing form", used to report nonsalary income to the IRS for federal tax purposes There are variants of 1099s, but the most popular is the 1099NEC If you paid an independent contractor more than $600 in a financial year, you'll need to complete a3006 · You must send the contractors and the IRS a Form 1099MISC—or, starting in tax year , a Form 1099NEC—to notify them about the amount of nonemployee income you paid to the contractors You will use Form 1096 to summarize the information provided on all the 1099MISC or 1099NEC forms you sent to contractors

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Form 1099 Int Pdf Abcgray

Form 1099 Nec Instructions Reporting Non Employee Compensation For Taxbandits Youtube

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Is Your Business Prepared For Form 1099 Changes Rkl Llp

What Are Irs 1099 Forms

What S The Irs Form 1099 Nec Atlantic Payroll Partners

Form 1099 R Instructions Information Community Tax

Need To File 1099 Misc For 18 What You Need To Know S J Gorowitz Accounting Tax Services P C

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

Printable Irs Form 1099 Misc For 15 For Taxes To Be Filed In 16 Intended For 1099 Template 16 Irs Forms 1099 Tax Form Tax Forms

1099 Forms And More At Everyday Low Prices Discounttaxforms Com

What Is Form 1099 Misc When Do I Need To File A 1099 Misc Gusto

Schwab Moneywise Calculators Tools Understanding Form 1099

What Is Form 1099 Nec

Limited Liability Companies And Form 1099 Reporting Cwmpk

Miscellaneous Income Form 1099 Misc What Is It Do You Need It

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

Printable And Fileable Form 1099 Misc For Tax Year 17 This Form Is Filed By April 15 18 Fillable Forms Irs Forms 1099 Tax Form

:max_bytes(150000):strip_icc()/Screenshot97-2634390b2e984de3b6aecbab43ad252d.png)

Irs Form 1099 K What Is It

Form 1099 Nec Or Form 1099 Misc Delano Sherley Associates Inc

:max_bytes(150000):strip_icc()/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

1099 Misc Form Fillable Printable Download Free Instructions

What Is Hsa Form 1099 Sa Hsa Edge

Quickbooks 1099 Tax Form Changes At Year End Insightfulaccountant Com

How To Fill Out Irs 1099 Misc 19 Form Pdf Expert

E File Form 1099 Misc Online How To File 1099 Misc For

1099 Misc Form What Is It And Do You Need To File It

What Is Form 1099 Nec How Do I File Form 1099 Nec Gusto

Understanding Your Tax Forms 16 1099 B Proceeds From Broker Barter Exchange Transactions

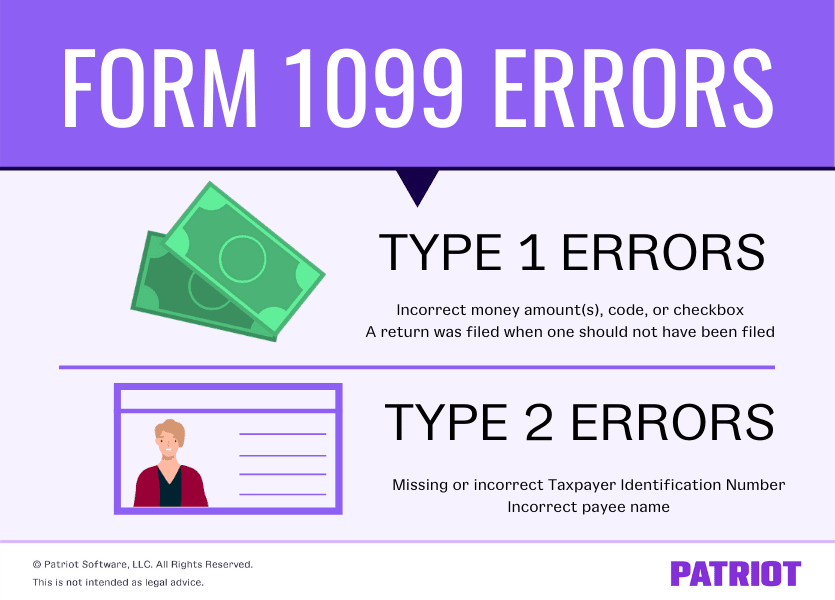

Corrected 1099 Issuing Corrected Forms 1099 Misc And 1099 Nec

How To Fill Out A 1099 Misc Form

Irs Makes Major Change To Annual Form 1099 Misc Information Return Gyf

1099 R Software 1099r Printing Software 1099 R Electronic Filing Software 1099r Software 19

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

1099 Misc Tax Basics

/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

10 Things You Should Know About Form 1099

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

What Are Irs 1099 Forms

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

Get Clear On The Difference Between The 1099 Misc And 1099 Nec

Your Ultimate Guide To 1099s

Ready For The 1099 Nec White Nelson Diehl Evans Cpas

1099 Misc Nonemployee Compensation Is Now Form 1099 Nec Blue Summit Supplies

Form 1099 R Wikipedia

Form 1099 Misc It S Your Yale

What The Heck Is Irs Form 1099 S And Why Does It Matter Retipster

1099 R Software To Create Print E File Irs Form 1099 R

17 Form Irs 1099 Misc Fill Online Printable Fillable Blank Pdffiller

1099 K Tax Basics

Get Ready For The New 1099 Nec And Changes To 1099 Misc Filing W9manager

1099 K Software For 1099 K Reporting Print Efile 1099 K

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

What To Do With The Irs 1099 C Form For Cancellation Of Debt Alleviate Financial Solutions

How Do You File 1099 Misc Wp1099

Form 1099 Nec For Nonemployee Compensation H R Block

Form 1099 Nec Now Used To Report Non Employee Compensation Ohio Dairy Industry Resources Center

Fillable And Printable 1099 Irs Form Online

1099 Nec 1099 Express

An Employer S Guide To Filing Form 1099 Nec The Blueprint

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)

Form 1099 Definition

Video What You Need To Know About Form 1099 Nec Olsen Thielen Certified Public Accountants Consultants

1099 Misc Form Copy B Recipient Discount Tax Forms

Change To 1099 Form For Reporting Non Employee Compensation Ds B

Small Businesses Get Ready For Your 1099 Misc Reporting Requirements

How To Fill Out And Print 1099 Nec Forms

Form 1099 Reporting Tips For Small Business Owners Cpa Practice Advisor

There S A New Tax Form With Some Changes For Freelancers Gig Workers

Learn How To Fill The Form 1099 R Miscellaneous Income Youtube

Form 1099 Nec Now Used To Report Nonemployee Compensation Ohio Ag Manager

Do You Need To Issue A 1099 To Your Vendors Accountingprose

0 件のコメント:

コメントを投稿